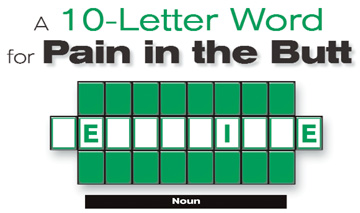

It’s time I spoke out on that terrible, nasty, I’m-afraid-to-say-it-out-loud, 10-letter word. You heard right. Not a four- or five- letter word or even the “R” word (as in recession) hurts as much as this 10-letter word.

It’s time I spoke out on that terrible, nasty, I’m-afraid-to-say-it-out-loud, 10-letter word. You heard right. Not a four- or five- letter word or even the “R” word (as in recession) hurts as much as this 10-letter word.

What is it that makes people so scared to say this word out loud? I think it goes back to ancient Rome. Just kidding. But I do think that this word is so painful for some people that it’s become a pain for us all.

Have you figured out what the word is yet? I’ll tell you if you haven’t guessed. It’s deductible. As an owner of a small chain of automotive collision shops, I think I’ve heard it all when it comes to deductibles. A typical conversation with the average auto collision repair customer generally flows something like this:

Estimator: “Oh, by the way sir, you do realize you have a $500 deductible on your repairs?

Customer: “Don’t I pay that to the agent?” or “They said they’d bill me for that,” or “If I’d known that, I’d have gone to the shop down the street. They said they’d cover my deductible and give me a car to drive.

Estimator: “We’d be glad to help you with your deductible. You can put it on a credit card and make payments.”

Customer: “All my credit cards are maxed and I’m paying for my dog’s operation, so I can’t pay."

Estimator: “I’m really sorry to hear that about your credit and dog. Can you make payments?”

Customer: “I already told you, the guy down the street promised to waive my $500 deductible and give me a loaner car. If you want the job, you’ll have to do the same.”

Estimator: “I’m sorry sir, but on a $4,500 job, there’s no way we can save $500. Is there some part of the job you can leave undone, like that scratched bumper or scraped wheel?”

Customer: “I really want you guys to do the job because I hear you do great work. But I can’t afford the $500, and I don’t want to give up anything.”

Estimator: “Sir, we’d love to do your job, but there’s no way we can repair your car without compromising the quality of repair. Don’t you think the shop that promised you all those savings is going to have to give up something? The only difference between us and them is that I include you in the process. They aren’t going to give you a choice. They’ll do what they want to save your deductible — at your car’s expense.”

He doesn’t have the money to pay his deductible, let alone the rental car bill that grows larger every day. The whole process becomes a “monster.” He can’t bring the rental back because now it costs more than the deductible, and he didn’t have the money to pay the deductible in the first place. So now what does he do?

Maybe he could drop the rental at night and try to take his car with the spare keys. (It’s been done before. It’s not an original thought.) Or he could negotiate the cost, which is something he should’ve tried on day one, not day 14. But I guess there’s no harm in trying.

In Illinois, it’s against the law to hold the car ransom if the customer doesn’t pay. One quick call from an attorney gets the car released, money or not. Fortunately for us, not everyone knows about this law. Sometimes we can bluff for a day or two — and also get our deductible. Usually the customer can come up with some money.

Depending on whether your shop needs the cash flow, you might opt to take the $3,400 insurance check and hope to get paid the balance. But we don’t like to let the car go without the customers participating in some way, if we can help it. Even if it’s only $20 or $30, it’s better to see them participate.

You can turn them into a collection agent. And five years from now, when they want a new car or house, they’ll have to clean up the black mark on their record, if they want a new loan. Even though this could take years, there’s some personal satisfaction in this process because, if you’re patient, eventually you might win now and again.

OK, having had some fun at the expense of the unpaying customer, the real reason I decided to venture into this topic is to share an idea with you. It may seem a bit old school, but here goes.

Remember way back when you were young — or maybe you are young — and you were about to enter into what felt like the biggest decision of your life — a home mortgage? Well, when my wife, Nancy, and I got married in 1970, we knew we’d buy a house someday. I’m sure you’re thinking, “What does this have to do with deductibles?” Keep reading. I promise I have a point.

In 1971, we found our dream house for $14,500 — a small fortune for two young, working people. The finance company put a deal together for us that made it seem attainable, so we scraped up the $1,000 down payment and our loan was accepted. Our payments were $145 a month for 30 years at 6 percent interest. It seemed like a million dollars at the time, but we knew if we were very careful, we could make our payments and still survive with a somewhat normal life.

Finally, closing day on our loan came, and we sat at a big, oval table where we passed an enormous stack of papers around to sign. One paper in that stack was titled “Escrow Account.” I asked, “What’s this?” The title company representative explained that this was the monthly amount they added to our payment to guarantee our property taxes and insurance would be paid each year.

“Well,” I thought to myself, “this is a bunch of baloney. My payment is now $231 per month, almost more than we can afford.”

I looked at my young bride with that look that asked, “What do you think? Can we make this?” Nancy shrugged her shoulders and gave me a positive nod. So we both signed the papers for our new escrow account.

Down deep, Nancy and I both knew why they did this “escrow” thing. They knew we’d have trouble with taxes and insurance. We might have let our insurance lapse if times got tough, but that would leave the bank vulnerable and we sure wouldn’t want that, would we?

This brings me to my actual point that I’ve so nostalgically built up to for you.

The scenario is: I’m Mr. Customer. I go to my insurance agent to buy car insurance. My driving record isn’t bad, but it’s not perfect. I had a wreck two years ago that was my fault. Well, the agent quotes the rate for me, and I say I can’t afford it. I ask him what I can do to lower my payments.

My agent gets a distorted look on his face, scoots around some papers and makes a couple of entries in his computer. Now he looks me right in the eye, sighs and says, “This is against my better judgment, but we can change your $100 deductible to $500, drop your rental and towing and lower your expense limits from $500,000 to $300,000. All this will keep your premium about the same as it is now. But I don’t recommend it.”

Naturally, I, Mr. Customer blocked out everything the agent said except, “This will keep your premium the same.”

I ask where to sign.

The way I see it, this agent has just set up an impossible situation for his customer. The agent already knows that this customer can’t afford $100 to fix his car, let alone $500, because the customer already told him so. So what happens when Mr. Customer wrecks his car and takes it to the body shop?

Mr. Customer comes into the body shop to schedule some repairs estimated at about $2,500. The car’s still drivable but one headlight’s smashed out. So you, at the body shop, schedule the repairs, order the parts and then ask the dreaded question: “Mr. Customer, you do know you have a $500 deductible and no rental coverage on your policy, don’t you?”

The customer might say, “That’s impossible, I carry all the best coverage!”

Then you say, “I verified the coverage with your agent, and I’m sure it’s correct.”

Mr. Customer finally replies, “Go ahead with the repairs and I’ll be checking with my agent. There must be some mistake.”

Well, we all know there was no mistake, but there is a way that the insurance company or agent might have helped Mr. Customer. It’s called an escrow account. By creating an escrow account against his deductible and other coverage, Mr. Customer is less likely to be caught off guard.

The agent knows that his customer can’t afford a $500 deductible but that he might be able to afford an extra $10 per month on his monthly payment. And after only four years, he’s saved enough for his deductible.

Now you ask, “Is this possible?” Honestly, I’m not sure myself, but if it’s possible, let’s see if the concept can be more desirable to the customer by offering him the chance to earn interest on that account, huh?

Insurance companies are in the investing business, and if the customer drops his policy, all moneys would go to the customer, after all bills are settled. And if he’s lucky enough to go four or five years without a wreck, he now has a zero deductible and the agent is a hero all around.

There’s one more situation in which this deductible savings might help. If he was lucky enough not to have an accident for five years and wants to buy a new car, this escrow fund may cause him less pain when the finance company requires him to carry full-coverage insurance. This money lets him go for a higher deductible and transfer his escrow account so he doesn’t have to pay it all over again with the next agent.

The customer doesn’t want the bank to buy insurance for him. It only covers the car for the bank, with no liability coverage for him. So this extra fund can help in many ways. Even a person who can afford (notice I didn’t say, “likes”) to pay his deductible would probably enjoy not having to pay after an accident. Or even better, maybe he could pre-pay $500 into his account and carry a $100 deductible. What an advantage that would be.

Who knows, maybe my escrow idea won’t hold water. I’ve talked to several agents and adjusters but, so far, can’t get anyone to bite. However, until they stop selling insurance for deductibles that most people can’t afford, the “deductible monster” is going to be a problem. So I say we lobby our insurance companies for relief.

As it stands, body shop owners and employees are responsible for collecting deductibles, not the insurance companies. One thing I’m sure of is that I’m tired of being an insurance-deductible collection agent and not being paid commission for my services. The responsibility needs to shift back to the insurance company and the person who so recklessly sold that high deductible to our customer in the first place — the agent.

Andy Batchelor owns Andy’s Auto Body of Alton, Inc. in Alton, Ill., and has been a self-employed automotive repair owner for nearly 30 years. He’s a certified Automotive Specialist with training from Rankin Technical School, has achieved the I-CAR Platinum Individual designation, has Master Collision Certification from ASE and a degree in Business Administration from Lewis and Clark Community College. Batchelor also serves as I-CAR’s Southern Illinois Training Chairman. Batchelor and his wife, Nancy, reside in Alton, Ill., and have two children, both married and living in the suburbs of Chicago. Batchelor can be reached at [email protected].