If you’ve got it, flaunt it. What better for a body shop to flaunt than a certificate from an auto manufacturer saying the shop restores its models to manufacturer’s specs?

Smart shops get certified so they stand out from the competition and offer customers concerned about shoddy repairs a measure of comfort knowing a shop is third-party “certified.”

A Certain Cachet

There is a cachet to certification – but since the programs are not something many consumers think about after a collision, it’s up to both body shops and OEMs to promote the programs’ benefits. Consumer awareness tends to be higher for repair certifications for top-end lines. However, for any shop, a certification – or multiple certifications – makes a great selling point.

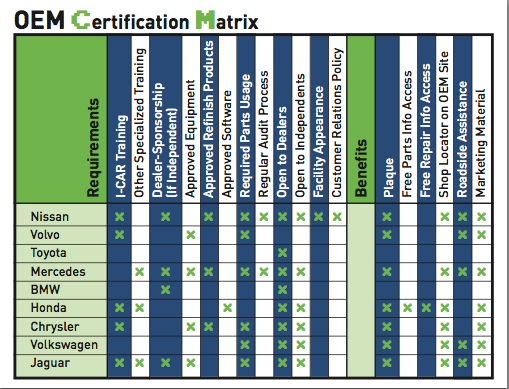

The programs run from a simple “Pay a fee and buy our parts and you are certified” to more stringent programs such as BMW, Audi and Mercedes-Benz where equipment and training are required.

In some cases, I-CAR Gold qualifies a shop. Other OEMs require in-house training and equipment. No OEM hands out certifications like candy on Halloween – they must be earned.

“It isn’t cheap, but it’s no big pain,” says Matt Dewalt, AAM, vice president of Scott’s Collision Center in Stroudsburg, Pa., and Scott’s Auto Service, Easton, Pa. He runs certification for both shops.

“We’ve always strived to be a leader in our market and offer every possible benefit to our customers,” says Brad Zara of Zara’s Collision Center, Springfield, Ill. “OE certifications are simply an extension of this benefit.” An independent shop, Zara’s has held Honda/Acura shop recognition for three years and just recently gained Chrysler certification.

GW & Son Auto Body in Oklahoma City, Okla., has been a certified shop since 2005. Gary Wano, Jr., executive vice president, says he was pushed to certification by DRP concessions.

“I was fed up with competing on the basis of repair price,” he says. “We began operating as GW & Son in 1985 with a tag line: Quality has its price, price alone has no quality. Then we find ourselves in a bidding war for work. It didn’t take us long to understand we wanted to compete based on all-over merit, and the OE-certified programs were the tools we used to legitimize this tag line.”

Today, GW & Son trumpets the fact that it’s Oklahoma City’s only body shop certified by Jaguar, Volvo, Mercedes-Benz and aluminum body. And it’s currently pursuing BMW training.

“I believe that we are still in a stage where consumers assume that a reputable shop is going to be qualified to repair their vehicle,” says Zara. He says extremely high-end vehicles requiring specialized equipment are the exception. “Certification on what I will call ‘average vehicle makes’ may not be sought by consumers at this point.”

Dewalt of Scott’s Collision’s decision was strictly business. “Certification adds more credibility to the business,” he says. The shop first got VW certified, then added Nissan, Chrysler and the aluminum Corvette Z06.

High Price

There is a price. Wano puts the average cost of a four-day factory certification at $20,000 when travel, per diem and lost production are figured in to the equation. Some training programs last two weeks.

“We have invested in one technician who traveled to Stuttgart, Germany, twice for Tier-1 aluminum training,” Wano says. All told, his multiple OEM program trainings equate to hundreds of thousands of dollars.

Specialized tools often are required. “We have around $300,000 of equipment purchased,” he adds.

Oklahoma City is not the biggest luxury vehicle market. Wano says the cost associated with his level of commitment can be prohibitive when most of the big producers work with insurers that have implemented cost saving rules for these repairers to live by.

“I repair roughly 18 percent less autos with a 13.4 percent increase in revenues compared to my stats while on the DRP programs,” he says. These numbers are before completing training for the BMW brand.

Due to the limited number of high-end vehicles in his market, too, Zara chose not to pursue certification in BMW, Audi, Jag, etc. “They are typically very large investments,” he says.

Adds Wano, “There is a lot of money wrapped up in certification, but the return is great.”

Dewalt agrees. His first certification, from VW, cost about $6,000 and will run about $3,000 for renewal. Nissan cost him $2,250 and Chrysler about $1,000 with a similar annual renewal.

“The biggest time and financial requirements of the Honda ProFirst recognition and Chrysler certifications happened to be one that we have maintained for a long time: I-CAR Gold Class,” Zara says. Aside from that, there was no other cost for Honda certification.

Chrysler’s was more rigorous with requirement of an on-site, in-depth inspection. “I believe it was a $2,900 one-time fee that we were able to cover with parts rebates,” Zara continues. “The parts rebates are certainly measurable. However, the generation of business is not as clear at this point since our certifications are just a part of a much larger marketing initiative.” In It to Win It

In It to Win It

Competition is especially keen in the upscale market. “Shops have to be in it to win it,” says John Donito, manager of after-sales field support for Volvo, Rockleigh, N.J. “The luxury customer is a completely different cat. We have to be sure both the dealer and outside shop are what they say they are…that they have the commitment to facilities, training and quality.”

For that reason, BMW restricts certification to dealerships. “That is a legal restriction, by contract,” explains Marcos Ehmann, wholesale manager for BMW. “We require a minimum of 51 percent ownership.”

Likewise, Toyota does not certify non-Toyota dealership shops, according to Jerry Raskind, wholesale parts manager for Toyota.

Hyundai doesn’t have a body shop certification program just yet. However, look for the company to have something to talk about potentially in late summer 2013.

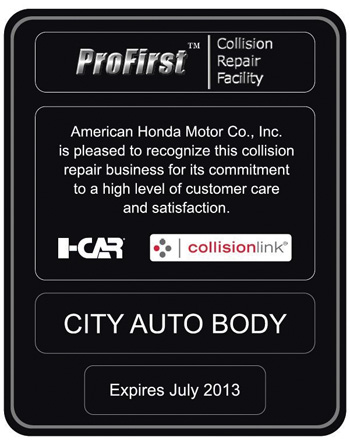

Honda kicked off its “Body Shop Recognition” program in June 2009, recognizing shops that used Collision Link and that were top performers for their respective paint companies. That program ended on April 30, 2012. The current ProFirst recognition (not certification) program began Oct. 1, 2012.

“It is what we consider the ‘next level,’” says Gary Ledoux, assistant national manager for American Honda Motor Co.’s Collision Parts and Service Marketing.

In Honda’s original program, a shop (dealer-owned or independent) had to be sponsored by a dealer parts department. That was eliminated with the new ProFirst program.

“Now, any shop can register simply by going to ProFirst.honda.com,” Ledoux says.“Continuing with Collision Link made sense because of all the inherent benefits,” he explains. “As our Honda and Acura products have become more complex and sophisticated, not only in the way they are built but also in the construction materials used, we knew we needed collision technicians who were versed in the new technologies and who could make a proper repair. Thus, we turned to I-CAR.” Other OEMs have gone the same route.

With less than 1 percent of the U.S. market, Volvo can’t afford to do in-house certification of shops. Rather, they work with I-CAR. “They are the industry gold standard,” Donito notes. VW also requires specific I-CAR courses for its program.

Scott’s Collision is a couple of courses away from achieving I-CAR Gold. Both Nissan and Chrysler will recognize those courses, Dewalt notes. In some cases, an OEM will certify a shop that is just short of I-CAR Gold as long as they achieve it within a year. However, a shop that is not well on its way will not get any slack.

GW & Son is not I-CAR. Wano figures they put enough resources behind OEM programs. “I had wanted to do things with I-CAR,” he says. “But the manufacturers we have do not require it or recognize I-CAR as part of their certification. So I see no need to get more outside training.”

Volvo certifies both on-site Volvo repairs and independents. “A shop does not need an ownership relationship, but normally there is a partnership there,” Donito says. The body shop will purchase parts through the Volvo retailer, and the Volvo mechanics will work on things like resetting service lights or ABS lights.

Regardless of whether the shop is tied to a Volvo dealership or an independent, the process is the same. The local Volvo retailer supplies documentation for the body shop to fill out. That information is evaluated at Volvo headquarters in New Jersey, with review by a local representative.

While fit and finish are important, that is not the whole game. Volvo evaluates body shops for parking, identification and safety. Keep in mind that these customers are an upscale group.

“The shop doesn’t have to look like a Volvo retailer, but it has to be commensurate with Volvo standards,” Donito says.

Some OEMs, including BMW, will not certify a body shop that is not part of a dealership. Rather, they will promote the shop as “BMW trained.”

Payback on all these programs is good. For instance, Honda’s Collision Link uses a VIN-scrubbing technology, which helps ensure that the shop gets the right part the first time, saving time and trouble. ProFirst recognition is open to dealer-owned shops and independents – as long as the independent meets program requirements. These include use of OEConnection’s CollisionLink and status as I-CAR Gold Class.

“In addition, someone in the shop must have completed the Honda/Acura-specific I-CAR class, HON01,” Ledoux says. Having I-CAR administer things saves Honda money, too.

Thus, for shops and dealerships, success is a two-way street. “Thanks be to God, the relationship between our sponsoring dealerships is one of incredible mutual respect,” Wano says. Customers’ View

Customers’ View

Many OEMs do not have much interaction with customers when vehicles are repaired at independent shops. But the shop owners who are in certification programs appreciate the cachet.

The overriding benefit to customers is peace of mind. They can be sure that, as far as their insurance company allows, OE parts have been used and that the vehicle is repaired to OEM safety and technical standards.

“This ensures that the vehicle structural integrity is maintained and safety systems are repaired to Volvo standards,” Donito says.

Says Ledoux, “CollisionLink facilitates our conquest program, which allows greater use of Honda Genuine parts. Having a shop that is I-CAR Gold Class means that the technicians are well-trained. We feel this will result in a better repair and a safe repair for Honda customers.”

Honda dealers win because, with CollisionLink, they sell more Honda/Acura genuine parts and it saves them some administrative time. Shops get the right parts the first time and get to use more OE parts. “It works for the consumer because they get a higher degree of OE parts, and we believe they are getting a better, safer repair from an I-CAR trained shop,” Ledoux says. “And it works for American Honda because we feel our customers will be getting a better repair at a ProFirst shop.”

Drive out of a Volvo-certified body shop and you get a one-year, unlimited mileage warranty for all parts installed. That warranty runs in tandem with the body shop’s own fit and finish policies. However, the associated Volvo shop does not indemnify the body shop work, Donito says. The customer must work with the body shop on any concerns.

Wano plays up his shop atmosphere. “It is not uncommon for us to offer a tour to our high-end customer base,” he says. During this tour, the customer will see multiple high-end cars in various stages of repair in a clean and orderly facility.

“We lose very few customers, especially when they ask a competing facility for a similar tour,” Wano says.

Insurers are a different animal. Someone must resolve questions with the customer’s insurance policies, several OEMs say. “You have to deal with insurance company micro-management with salvaged or used parts,” Donito says. “The best of intentions can be laid to the side.”

While he’s enthusiastic about the ROI on his certifications, Wano notes there often are insurance issues. “You won’t be working at the prevailing price,” he warns shop owners considering certification. “A shop that is part of a DRP program will have a difficult row to hoe. You’re not going to make the money that you want to make to recover your investment. You might have to think outside the box a bit.

“GW & Son KPIs do not fit within the severity expectations of the carrier, yet the carrier pays the bill. We simply repair the car per OEM requirements. That documentation and customer support, and the seven-plus years of experience in the program, lend to our credibility.”

Wano says that some insurance companies, recognizing that their customer pays a hefty premium to insure a Jag or Volvo, have no problem using a certified shop. “Those insurers want to be sure their customer base is taken care of,” he says. Other companies, he says ruefully, are not as certification-friendly. “We’ve had feathers ruffled on both sides.”

Since at least three of GW & Son’s OEM programs specifically forbid use of used parts, tensions can mount.

“In my opinion, anyone looking to become certified within the high-end luxury brands simply needs to understand that your customer is the auto owner, and your repair process is driven by the OEM. There is no room monetarily to stay OE-certified compliant while serving within the DRP environment,” Wano says. “You can’t serve both masters. Margins get really shrunk. Either you are in a DRP program or you are not.”

Zara, who is a DRP shop for a number of insurance companies, sees it a bit differently.

“I feel that our certifications are just one more thing that can set us apart from the other shops in our market as well as other providers on these DRP programs that we compete with,” he says. “We have gotten a few jobs due to our certifications. However, the immediate benefit has been more in the area of expanded price matching on parts and parts rebates.”

Many OEMs put the need for dealer replacement parts right into the customer’s hands. “The structural integrity of your Volvo depends on every body part used,” the company’s flier to customers says. “It is important to insist on Volvo genuine replacement parts whenever possible.” Support like that makes it easier for a certified shop to support clients who want cars fixed to the manufacturer’s specifications.

While Zara says he has not seen any specific increase in insurance business due to their certifications, “We have gotten some nice comments on social media and cards in the mail following the announcements of our certification achievements.”

Other Considerations Some certifications are easier to obtain than others…although to the customer, they all look good hanging on the wall. Nissan and Chrysler, for instance, are easy compared to BMW. That is not to say the former certifications are flimsy or not worthwhile. Rather, they might be better entry points for a shop striving for certification before taking the plunge into a more expensive program.

Some certifications are easier to obtain than others…although to the customer, they all look good hanging on the wall. Nissan and Chrysler, for instance, are easy compared to BMW. That is not to say the former certifications are flimsy or not worthwhile. Rather, they might be better entry points for a shop striving for certification before taking the plunge into a more expensive program.

There is another consideration, too. Can a shop afford to have certified technicians working on a Ford pickup? On the other hand, can the shop afford to ignore a long-standing good customer’s “other” vehicle?

“Training represents a great deal of cost,” Wano says. “I can’t afford to have a tech working on something else.” GW & Son answered that question by opening a second shop to complement the 32,000-square-foot home operation.

Thus, ROI matters. “I am not a 503c,” Wano states. “We are a for-profit corporation.” Due to the OEM repair requirements, he has found his estimate line count has increased, as well as the rate of repair. He credits this to the OEM procedures and a customer-only focus.

“We only have State Farm as a referral source because they understand and are willing to pay what it takes,” he notes. “We have found our repair remittance is justified and supported.”

No matter the program, manufacturers require regular recertification. Volvo is typical with recertification required every two years.

Over time, individual shops and OEMs get a feel for the tangible and intangible benefits of re-signing. “We can measure the number of shops on the program and the attendant parts sales… both of which are headed up,” Ledoux says. They also measure the number of hits on their shop locator site (collision.honda.com), which reveals how many consumers looked for a recognized body shop. “This is also headed up,” Ledoux says.

Does that mean business? While saying it is difficult if not impossible to measure, Ledoux says they know anecdotally that programs build traffic. “Shop managers have told us that if a Honda owner comes to their shop after seeing them on the ProFirst shop locator site, chances are really good that they will write the estimate and sell the job because the customer feels that their car will be fixed in a complete and safe manner.”

Although Scott’s has been Nissan certified for less than six months, Dewalt was recently surprised by getting at least four jobs as a direct result of the Nissan website referral program.

He admits he didn’t expect a dime’s worth of work from the VW certification – the closest VW dealer is 45 minutes away. “But right away we got three referrals, including a couple from out of state,” Dewalt says. While New Jersey is just across the Delaware, jobs came from New York City.

Wano says Mercedes-Benz USA does a great job informing the owner about the pre-engineered crash ability of their product. “To restore this crash resistance, the damaged Mercedes product needs to be repaired by a trained and equipped facility,” he notes.

It is that kind of OEM support that keeps shops coming back for recertification.

“We will continue to incorporate our certifications into our marketing to bring more awareness to consumers,” Zara concludes.

Curt Harler is a Cleveland-based freelancer specializing in the auto, technology and environmental areas. He can be reached at [email protected].