The Romans Group LLC has announced that its 13th annual white paper, “A 2017 Profile of the Evolving U.S. and Canada Collision Repair Marketplace,” is now available.

The Romans Group states that the four industry constructs or pillars that they identified over a decade ago – consolidation, contraction, convergence and constructive transformation – remain in place and are now stronger than ever. They continue to influence the collision repair industry’s long-term structural transformation within the entire auto physical damage landscape, affecting numerous dynamic macro market changes. However, the context of what they represent has evolved in ways that broaden their influence and impact on the future of the collision repair industry.

A summary of the current state of the four pillars underlying the continuation of the collision repair industry’s structural transformation includes:

- Consolidation: slowing – strategic clusters, tuck-in platforms; segment market share continues to grow – scale matters; scale as a competitive advantage or scale is fail

- Contraction: stabilizing – temporary equilibrium; simple and complex alliances and partnerships; differentiation and diversification

- Convergence: omnipresent – moving at extreme speed; confluence of prevailing conditions driving industry transformation; repairers are at the intersection of a traditional business model and practices and the innovative, disruptive technology driving change

- Constructive transformation: long-term, multi-faceted, multi-segment transformation within various auto physical damage; more complex, slower than anticipated, integration challenges, unintended consequences

U.S. Collision Repair Industry

Collision repair revenue in all key market segments has increased since 2006. This growth is reflected most significantly in the sustained expansion progress by the four large independent consolidators and in the remaining >$20 million MLO independent and dealer repair segment. The 96 >$20 million MLOs represent 26.9 percent of the industry’s market size, which has grown from 24.6 percent in 2016 and is significantly higher than their 2006 share of 9.1 percent. Revenue trends in the MLNs (multiple-location network franchisors) and in the $10 to $19 million independent and dealer segments have been essentially flat.

Together, the four segments of top consolidators – >$20 million independents and dealers, multiple-location franchise networks, and $10 to $19 million MLOs – represent annual revenue of 35.9 percent of the total addressable market, as compared to 32.8 percent of revenue processed in the U.S. in 2016. From 2006 to 2017, the Top 4 MLO consolidators have experienced robust growth due to continued incremental organic growth, multiple-location platform acquisitions, an increasing number of single-location acquisitions, and a brownfield and greenfield build strategy.

The following chart reflects the ranking of the top 10 multiple-location operators and networks for 2017. When Abra’s franchise revenue is excluded, Boyd/Gerber moves into the third position:

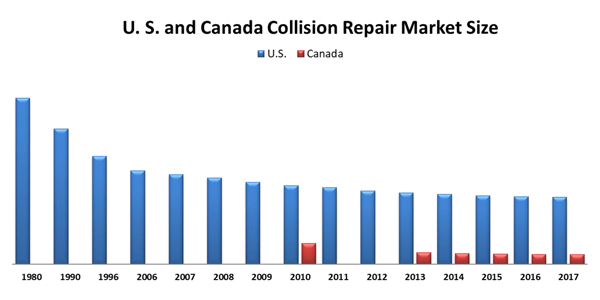

Canadian Collision Repair Market

The Canadian market continues to consolidate, with the franchise and banner segment now representing a significant 58.1 percent share of the Canadian private insurance auto market. When you add the >$10 million MLOs in Canada, the combined larger segment has a significant 78.4 percent of all the private passenger insurer and consumer-paid market. Under the All Repairers column, we see a combination of banner, franchise and independent groups represented in the Top 10 ranking category.

Although the U.S. has seen an increase in consolidation within the multiple-location operator segments, Canada remains significantly more consolidated in the revenue generated by the combined franchise and banner and >$10 million MLOs. In Canada, this combined segment group represents a 78.4 percent market share versus the combined 35.9 percent share for the same U.S. segments.

Within the U.S. market, the >$20 million independent and dealer MLO segment is the largest, while the franchise and banner network MLOs remain the dominant business model in Canada. When ranking all repairers for the U.S. and Canada, and consolidating those that operate in both countries, four operate in both the U.S and Canada while five are in the U.S. only and one is solely in Canada.

These top 10 U.S. and Canada combined repair organizations represent 22.6 percent of the combined collision repair revenue, an increase since 2012. This revenue is managed through significantly more locations than in 2012, representing 10.1 percent of combined collision repair locations for the U.S. and Canada for 2017.

Since 2010, Canada has lost a significant number of its collision repair locations. Compared to the U.S., Canadian average annual repair revenue in 2016 was 54.7 percent lower than the U.S. average. As a sign of ongoing consolidation, the average revenue per repair facility for both Canada and the U.S. has been steadily increasing over the last few years.

As The Romans Group discusses in this edition of their annual paper, there are a broad base of prevailing market conditions simultaneously impacting the transformation taking place within the wide-ranging collision repair ecosystem. Five secular trends are causing more immediated challenges and opportunities for repairers and many other relevant constituent groups, including:

- auto insurance companies

- telematics, 5G and the connected car

- ADAS and the evolving autonomous vehicles

- OE certification programs

- technician shortage

The pace of collision industry consolidation and contraction has shown signs of slowing down over the past 15 months. MSO consolidators will continue to grow and will do so in the immediate future through single-shop or smaller MLO platform acquisitions, brownfields and greenfields. Larger MLO market share and scale are now a clear competitive advantage that is also viewed today as a competitive asset.

The Romans Group’s future view remains consistent that the collision repair industry over the next decade will involve the continued long-term, multi-segmented structural transformation which will impact the entire auto physical damage ecosystem for all existing and many new companies providing products, services, software and technology that in some way touches cars in the U.S. and Canada.

The Romans Group believes that the market segments profiled will continue to gain share within the collision repair industry and expand their revenue base, both through acquisitions and by adopting a diversification strategy that leads them to incorporate new lines of business services over the next few years, both in the U.S. and Canada.

The Romans Group’s report contains the complete results of their research and analysis for 2017, including over 50 charts and graphs and over 70 pages with historical trends and a future view. The report can be purchased by contacting Mary Jane Kurowski at [email protected].