Auto insurance premiums in the United States are at an all-time high, according to a new report.

Premiums are up 20 percent since 2011, according to the annual “State of Auto Insurance Report” from the Zebra, which describes itself as “the nation’s leading insurance search engine.”

“The report, which explores insurance pricing trends over time and by individual insurance rating factor, shows extreme pricing volatility in recent years and raises questions about how the insurance industry is reacting to changes in weather, legislation, technology and driver behavior,” the Zebra said in a news release.

The Zebra’s annual report examines more than 52 million auto insurance rates across all U.S. zip codes to provide insight into the many factors insurance companies use to price insurance, and why that pricing is unique to every individual.

“Insurance companies leverage thousands of data points to determine car insurance rates – things like your age, driving record and even your credit score,” explained Adam Lyons, founder and executive chairman of the Zebra. “Today, we’re also seeing extraordinary forces like overnight tech innovation and devastating natural disasters impacting rates. Our independent research seeks to uncover the trends and forces behind these rate hikes and to help the 250 million drivers in the U.S. make informed insurance decisions about their own coverage.”

Key findings reveal that the state of auto insurance in 2018 is:

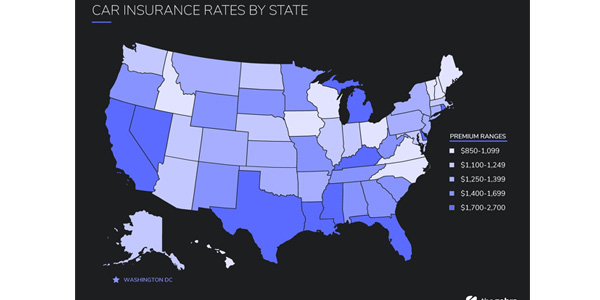

- Expensive – Car insurance rates in the United States are higher than they’ve ever been, with a national average annual premium of $1,427. Some U.S. cities have an average annual premium of more than $6,000.

- Volatile – Insurance rates in some states increased more than 60 percent over 2011, while others increased as little as 1 percent.

- Inconclusive about technology – Insurance companies are penalizing distracted driving for the first time since the advent of cellphones, though still not nearly as harshly as for other dangerous traffic violations, such as drunk driving. Insurers offer few if any discounts for having advanced anti-theft and collision-avoidance technology in your vehicle.

To download the report, visit the Zebra website.