It seems that every single week now, one of the major multiple-shop collision operators has acquired yet another store. It’s a buyer’s market, with declining accident frequency, higher costs and lower margins convincing some independents that the time to exit is now.

It seems that every single week now, one of the major multiple-shop collision operators has acquired yet another store. It’s a buyer’s market, with declining accident frequency, higher costs and lower margins convincing some independents that the time to exit is now.

Still, despite all the consolidation going on, the majority of shops in the industry are small, mom-and-pop single store operations. BodyShop Business’s 2011 Industry Profile report indicated that 91 percent of those polled own a single store. But insurers are increasingly preferring to do business with multiple-shop operators (MSOs) for multiple reasons: single point of contact, consistency of product, strong brand (market presence), the ability to offload DRP administration, strong KPI measuring systems, etc.

Market Trends

Consolidation is not unique to the collision repair industry. A host of other industries, ranging from hometown funeral parlors to local banks that used to know everyone personally, are under pressure to consolidate. There are many reasons why it has accelerated in the body shop world.

“Market growth is nearly flat, and projected growth will be anemic for the foreseeable future,” says Paul Gange, president and COO of Fix Auto USA, Anaheim Hills, Calif., a franchise that has network stores. He noted that while there are more licensed vehicles on the road today than in 1980, declining frequency translates to no real increase in the total number of repairable vehicles. “Margins are clearly not what they were a few decades ago, but the collision industry experience in that regard parallels that of other industries that have reached a state of maturity. The ability for a single operator or even regional MSOs to excel outside a network is becoming more challenging.”

“Market growth is nearly flat, and projected growth will be anemic for the foreseeable future,” says Paul Gange, president and COO of Fix Auto USA, Anaheim Hills, Calif., a franchise that has network stores. He noted that while there are more licensed vehicles on the road today than in 1980, declining frequency translates to no real increase in the total number of repairable vehicles. “Margins are clearly not what they were a few decades ago, but the collision industry experience in that regard parallels that of other industries that have reached a state of maturity. The ability for a single operator or even regional MSOs to excel outside a network is becoming more challenging.”

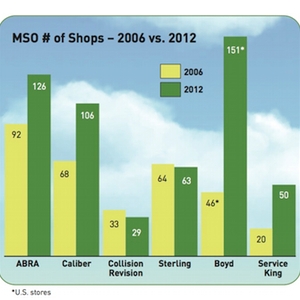

ABRA Auto Body & Glass of Brooklyn Center, Minn., is one of the operations that has been aggressively growing its footprint across the U.S. It has gone from 92 stores in 2006 to 124 in 2012. Says Duane A. Rouse, president and CEO of ABRA, “The industry has been fragmented and is in an overcapacity situation. Since the industry itself isn’t growing quickly, the better operators are taking market share from the marginal operators.”

Caliber Collision of Lewisville, Texas, has had pretty much the same growth rate in a six-year time period as ABRA, going by number of stores added in the last six years. It has gone from 68 stores in 2006 to 106 in 2012.

Caliber Collision of Lewisville, Texas, has had pretty much the same growth rate in a six-year time period as ABRA, going by number of stores added in the last six years. It has gone from 68 stores in 2006 to 106 in 2012.

“Like many industries, the collision industry, which is dominated by small, independent shops, found itself with much more capacity than vehicles to fill,” says Caliber President and CEO Steve Grimshaw. “This fact, coupled with flat-to-declining claims, higher expectations of customers, increased competition among insurance clients and the increased complexity of vehicles, made it a ripe market for consolidation.”

Aaron Schulenburg, executive director of the Society of Collision Repair Specialists (SCRS), views consolidation as a double-edged sword for single-store owners.

“Future prospects for single-location shops are fraught with significant challenges, regardless of consolidation,” says Schulenburg. “But competing in heavily consolidated markets has both advantages and disadvantages.”

Schulenburg feels that consolidation spurred by MSO/franchise growth in a market is similar to the commoditization bred by chains entering into a marketplace. “For independent single-location businesses to be able to compete, they’re going to have to define their audience and target them in a much more direct and specific way.”

David Byers, CEO of CARSTAR, Kansas City, Mo., says he expects to add 30 to 50 new stores in North America each year for the foreseeable future. He has a good sales pitch to independents, offering them group buying power, education, training and a relationship with insurance companies.

“There is a squeeze on profitability everywhere,” Byers says. “Small players typically don’t have the same financial controls as MSOs. There is a need for capital improvement. And insurance carriers are aligning themselves with MSOs.”

Room for Everyone

If anyone believes that the independent shop will one day be extinct, they should quit their worrying, according to John Mosley, owner of Clinton Body Shop, Clinton, Miss.

“There definitely is room for the independent,” says Mosley. “It depends on how you structure your business. Independents are not going away. If you build a relationship and do a good job, the customer will come back to you regardless of what choices the insurance companies give them.”

Says Marcy Tieger, principal with Symphony Advisors, “There will always be a place for small, independent businesses, even with industry consolidation.” Tieger says small business owners often forge strong bonds in their communities, and their “independence” can be a selling point to consumers.

CARSTAR’s Byers believes it will be a long time before independents are gone, but the day will definitely come. “There are 37,000 independents. We are the biggest MSO with 400 stores. It will be years and years before the independents are gone. However, I think the move to MSOs will rapidly accelerate.”

At the moment, no MSO has complete national coverage. But that day might not be far off.

“It used to be if you had five locations, you were a big guy,” says collision repair industry veteran Jim Keller. “Now you’re a large player only if you have 100-plus stores.

Keller is founder and president of the recently created 1Collision Network in Milwaukee, aimed at helping independents in Wisconsin and Illinois by offering an alternative to MSOs.

“The big difference with us is that we are not buying you. You maintain ownership of your business but become part of a name brand,” Keller says. He compares the 1Collision brand to True-Value hardware stores which keep the owner’s name but add a logo. In this case, the logo is a large, red numeral one.

The 1Collision brand will start in Wisconsin, Illinois and Iowa and branch into Minnesota, Indiana, Michigan, Ohio and Missouri. Keller says it will, for the near future, remain a Midwest brand.

Measuring Performance

The one thing MSOs have over single-stores, says Brock Bulbuck, president & CEO of the Boyd Group Inc. (Gerber Collision & Glass), is a proven system to measure performance.

“The MSO collision model has been proven to deliver on key performance metrics (KPMs),” says Bulbuck. He admits that 15 years ago, not all MSOs delivered on the promise of better KPMs. “But today, MSOs do,” he says.

Service King’s Bonner also believes KPI measuring favors consolidated operations.

“It’s difficult for an independent to offer reporting on a live, 24/7 basis,” Bonner says.

For any shop owner, measuring CSI, cycle time, touch time, etc., can range from a necessary evil to a fun part of the business. Johnny Mock, owner of Johnny Mock’s Auto Body Shop, Pittsburgh, Pa., readily admits he loves metrics and benchmarks. However, he indicates insurance companies go overboard with them.

“Insurance companies today have created a monster for us with dealing with customers,” he says.

Mock says his customers feel some KPI requirements are overkill. He cringes at the idea of twice-a-day updates given every time a car moves from one station to another. “Most customers want to know when the job is done,” Mock says. “Others give a CSI that you didn’t communicate enough. I can have an hour per car per week just in phone calls.”

As a larger shop with a good contingency of support personnel, he can handle that. And, with their volume, even a couple of dingers a month don’t hurt his statistics too much. He feels sorry for the shop that does 10 cars a month and has two or three customers complain about communications. They could have a 30 percent “dissatisfied” rating.

Consolidation Regions

Consolidation Regions

There are places where there still is little or no pressure to join a franchise or marketing group. “We have no consolidators or MSOs in Vermont,” says Mike Parker, Parker’s Classic Auto Works, Rutland. “I do feel that consolidators and MSOs are not in the best interest of a family-owned shop like ours.”

While Parker is out of the war zone in Vermont, there’s a storm brewing in huge metropolitan areas.

Mock thinks Parker’s story is typical. He believes that consolidation will take place most quickly in the heavily urbanized areas where economies of scale can be realized quickly.

“If you’re in a highly populated area, you’ll see more consolidation. In rural areas where population is thinner, you’ll see less,” he says. There, where a shop or two can dominate a small market, MSOs will have a tougher time achieving the numbers required for their business model. “MSOs will be choosy about where they locate.”

Addressing economies of scale, Boyd’s Bulbuck says, “The advantages economies of scale provide include management expertise and central service opportunities. We can add enhancements to our value proposition that are not possible at a single location.”

According to ABRA’s Rouse, MSOs appear to be taking more market share. Independents face the challenge of attaining the amount of investment in equipment, training, technology, etc., necessary to remain competitive. Mock admits there are challenges, but he finds it fun to overcome them.

“If you’re an entrepreneur and really want to run your business and control your own destiny, [being independent] is the way to do it,” Mock says. “Yes, it is frustrating. It is challenging, but I love the logistics and figuring the metrics to be successful.”

Mock knows whereof he speaks. For many years, his was a CARSTAR shop. “I backed out of it,” he says, noting that he wanted to run his own show. Today, with his son Jason a year or two from taking over the business, Mock is determined to stay independent.

Who Will Be the Victors?

Service King’s Bonner believes there will be a major shake-out in the next 12 months or so. Service King, with 45 shops across Texas, is the largest MSO in the state and third largest in the U.S. It was acquired by the Carlyle Group, a $159 billion asset group, in late July. Bonner moved up from CEO to chairman, and founder Eddie Lennox retained an ownership stake.

“The trend is for consolidation,” she says. “The biggest question is, who will be the successful consolidator? Who has the resources – the financial partners – and who has the ability to attract the most profitable independents?” She sees room in the game for several, but not many, victors to emerge.

This is not the first time the collision industry has seen consolidation. The first wave occurred during the late 1990s.

“During the first wave, we saw growth in companies without infrastructure, standard operating procedures and robust management systems in place that enabled MSOs to operate effectively as one enterprise,” says Marcy Tieger, principal with Symphony Advisors, Irvine, Calif. Some of those MSOs are no longer around, she says. “The ones who are still here would likely tell you that they’re doing things differently during this wave of consolidation.”

CARSTAR’s Byers says the victors will be those who get the most insurance work. Of course, he feels that MSOs – with better KPIs (key performance indicators) and more training – will lead the way.

Gerber’s size has allowed it to take on responsibility of DRP oversight for its own shops. “Insurers don’t have to spend infrastructure and money investing in that oversight,” Bulbuck says. “It’s another economy

of scale.”

The independent Mosley has no time for DRPs. In fact, he kept his shop out of State Farm’s program for five years (they’re on Select Service and he now participates in three DRPs).

“Instead of putting your business out there with good advertising and building a customer base, shops went to DRP programs,” Mosley says. He thinks this was a huge strategic mistake. And, he is one of several shop owners in Mississippi looking to change that.

A Different Consumer

The consumer of today is different, too. Fix Auto’s Gange calls them “professional” consumers of goods and services.

“A consumer’s expectations are shaped by their experience at the local Starbucks or other service encounters,” he says. “They, in turn, implicitly anticipate insurers meeting expectations that have been shaped by their retail experience – for speed, quality and best price, defying the value triangle.

“Insurers spend billions of dollars on advertising, and the requirements for surpassing customer expectations continue to escalate – and perhaps unfortunately, at the same time consumer demand for better products and differentiated services also continues to evolve and increase.”

Says Caliber’s Grimshaw, “Although scale brings an ability to invest in training, equipment and technology, and certainly improves purchasing power, success is based on an individual shop being able to satisfy customers within a 5- to 10-mile radius. It is a local business. This ensures independent shops will have a strong presence in this industry for a long time to come.”

Grimshaw sees the industry adapting and buying groups or franchising, giving independent shops more power to gain access to clients and improved purchasing power versus what they have today.

Schulenburg agrees that there will always be a place for small, independent shops as many consumers prefer them over big chains.

“There is a large population of consumers who would prefer to do business with small, local businesses,” Schulenburg says. “While larger organizations can market their service based on size/presence/national guarantee, etc., small business can play on the very positive aspects that make a locally owned and operated business unique to the community. It also may allow for those businesses to harness the ability to become more of a specialized business, rather than a ‘general practitioner,’ further providing distinctions that create an appealing value proposition. This is also where taking advantage of finding other consumer-oriented automotive service offerings (such as the things that might be found at the SEMA Show) can bolster return consumer business through an ongoing relationship that keeps you connected to your customer base between collision losses.”

Big Attention

While losing one’s “independence” might seem like a sad occasion, there are numerous positives for joining an MSO. Perhaps the biggest factor is training on the latest in paints and technology. Big guys get big attention from vendors. Vendors insist the little guys are important, too. They are, of course, but given the choice of making a sales call to a person representing 100 shops or two shops, where are you going to go first?

A shop owner who wants to “crystallize value,” as Bulbuck puts it, but still remain on the management team may opt to go the MSO route.

“Those who believe the right time to sell is now will be able to get the value of the business before the value diminishes,” he says. “Others want to create a career opportunity for themselves.”

Says ABRA’s Rouse, “Since the independent is typically selling their business, we let them know that our culture and commitment to the industry will greatly benefit their employees who will continue with the business after the owner leaves. For those who want to continue to own their business, ABRA’s franchise program offers proven operations processes, national purchasing power, ongoing training and recruiting support, as well as marketing and advertising support.”

Chains enforce standards and guarantees, which benefits both the customer and the shop owner. CARSTAR customers know that, should something go wrong, their guarantees will follow them from shop

to shop.

That’s also part of the benefit of an outfit like 1Collision. It offers marketing planning and support services, e-Marketplace software, a performance management system to track KPIs, a single point of contact with insurance companies, and educational and training programs in tandem with strategic partners.

Members of MSOs receive ongoing support to increase traffic, enhance insurance relationships and to be the “best in class” in their marketplace, 1Collision’s Keller says. The group charges a flat, monthly fee for membership and extra depending on the scope of marketing. For example, one body shop in Chicago hardly can afford $5,000 a month for a billboard. But 10 branded independents probably can spend $500 each to get the word out.

Training, infrastructure, specialized management techniques and pooled advertising are among the benefits Bulbuck sees. “This helps us increase our customer-pay sales as well as direct repair sales,” he explains.

Gerber has a centralized call center and a centralized estimate desk that puts a second set of eyes on damage estimates that are written at the shop level. “Essentially, we’re doing some of the checking that was done by insurance companies under DRPs,” Bulbuck says.

Even the wider economy has an impact. “With people choosing not to repair their damaged vehicles for economic reasons, fewer miles driven and accident avoidance technology, among other factors, there are simply fewer cars to repair and fiercer competition for those cars,” Tieger explains. “Combine that with the growth of large-scale MSOs and the enhanced relationships MSOs are able to develop with insurers, and smaller shops have to work that much harder to maintain or growth their market share.”

Insurance Impact

Many independents point fingers at insurers for driving them to the wall. CARSTAR’s Byers has no doubt that insurance companies would rather deal with a MSO than an independent.

“Insurance companies are looking for fewer shops on their lists,” he says. “What are the downstream implications of that? From the insurance company perspective, the MSO is the way to go.”

On the drive to consolidation, insurers certainly provide the fuel. “One of the interesting things is how quickly the insurance carriers are moving to the MSO model,” Byers says.

Adds Caliber’s Grimshaw, “Insurance companies are looking at reams of research on how to increase their customer’s overall satisfaction while optimizing customer policy retention and minimizing customer churn.”

Grimshaw points to J.D. Power & Associate research in 2010 (see chart) that demonstrates greater customer satisfaction results in less “switchers” and customers who “will shop in the next 12 months.”

“One of the drivers for this wave of consolidation is the influence of insurance companies that are looking to contain cost and are demanding superior performance in areas like cycle time and customer service,” Tieger says. This requires the ability to make a financial commitment on things like training and equipment or a common technology platform with capability to interface with an insurer’s systems.

“The bottom line is that keeping all these balls in the air can be much harder for a small business than it can be for a larger enterprise that may have people devoted exclusively to key areas such as IT, training and HR,” Tieger says. “One other consolidation driver has been the renewed interest of the financial community, which has been willing to invest in well-run companies, which has resulted in MSO growth.”

Mock credits, or blames, that move on the number of consultants – many ex-shop owners – who gather information to develop numbers on profitability.

“They tell the insurance companies…then the insurance companies tell us we make too much money,” says Mock. “What gives them the right to tell me how much money I can make if I’m charging a fair rate on a job?”

“The shops that are achieving the most success in working with carriers are those that are able to offer a product to the carriers which delivers on quality and customer satisfaction, while also creating a more efficient business model for claims administration,” Gagne says.

Bonner says she believes the insurers are being driven by customers to offer service alternatives throughout their region. “Insurers want to advise customers that they have a shop close to them,” she explains. A MSO is more likely to have a repair bay near the customer’s home, office or school than a

single-site operator.

“It’s the customer that’s driving it in this instance,” Bonner says.

Tieger agrees. “We believe the repairers who will best be able to compete in this environment will be MSOs that have multiple, consumer-oriented locations with geographic concentration, highly-trained technical, managerial and administrative staff, load leveling capabilities, high customer satisfaction, a common technology platform with capability to interface with an insurer’s systems, and centralized estimate review and audit capabilities, among other attributes,” she says. Those top- performing repairers must be willing to commit to a service level agreement and KPI guarantees with economic penalties and rewards, she adds.

Warranties boost satisfaction. CARSTAR’s Byers notes that most MSOs offer regional or nationwide warranties. “People have one accident every 6.7 years,” he points out. “People move just about that often, too.”

This gives the consumer a sense of well-being, Byers argues. “The consumer doesn’t care about the ownership structure. He cares about the brand. It’s just like any other retail storefront brand. When the consumer has an accident and needs help, they know a trusted brand like CARSTAR.”

Rouse says he thinks there will always be room for well-run businesses in this industry, regardless of the size. “If you own your own business, you’re in control of your own destiny, and you call all the shots,” he says.

Mosley would respectfully disagree. “This (consolidation) is absolutely insurance company-driven,” he says. He winces at programs like State Farm’s PartsTrader for parts bidding.

Others take the approach of selling the value of each independent’s metrics to the insurance agencies. Part of 1Collision’s marketing is making insurance agent calls. “We want to build a relationship with the insurance industry, local insurance agents and our independent members,” Keller says. “We want to show what shops have to offer and their performance statistics.”

Right now, one independent has the opposite problem. Mock’s area just experienced a massive hail storm and business is good. However, he has multiple steps to take before the insurance companies will approve a job. “The insurance company is beating the snot out of us,” he says. “They want to know how many ounces of clearcoat per panel you’re spraying.”

“We maximize DRP conversions,” Bulbuck says. Insurers recommend DRP to their customers and want their customers to use a DRP shop. With a large advertising and store-front presence, MSOs can help insurers meet that goal. With 150 locations in 14 states and 40 shops in the Chicagoland area alone, customers come to know the brand name.

“Companies with top-of-mind awareness help increase the DRP rate,” Bulbuck says. He says this branding helps improve the consumer’s comfort zone since they have a top-of-mind name for trustworthy collision repair.

“The customer is the ultimate winner in this,” Grimshaw says. “The shops that thrive during this consolidation will deliver better operating metrics and customer focus than those that don’t. They will also be equipped with the best trained employees, have access to the best equipment, and have management systems and processes that ensure operational consistency in every location.”

On top of that, Grimshaw says customers will be confident their cars were repaired to pre-accident condition and all customer service expectations were met.

“Not all consumers buy goods at Wal-Mart,” Gange says. “The same is true for insurers. Value is defined differently. For some, loss costs are critical, while for others, customer service is the primary metric. However, all insurers embrace the need for effectively managing their budget and service experience, which is best understood in terms of L&AE and their respective service experience.”

Not the End

Despite all of the expectations and competition, independents don’ need to throw in the towel.

“There always will be room for the good independent,” Bonner says. “There is a certain customer who likes to do business with an independent. The independent might be located close to the customer.”

Mosley opened a second shop about a 25-minute drive from the first in order to capture those other customers. He knows there are other areas where he could place a shop that would cut that customer’s travel time even more.

Groups that focus on customer service, invest in training and equipment required to fix today’s increasingly complex vehicles, and invest in systems and processes required to drive consistent operational performance will be the consolidators of the future, Grimshaw says.

Mock’s secret sauce is to limit the amount of business he gets from any one company. “I don’t like to see any one insurance company over 13 percent of my business,” he says. Meantime, his percentage of customer-pay jobs is increasing.

“We’re insurance friendly here,” Mock insists. “We try to work with them. But you can’t kowtow to them all the time. You have to be willing to say when things are not working out. I just ask the insurance companies one thing: Let me make some money and I can take care of your customers for you. If you’re not staying on top of your numbers, too much falls through the cracks.”

“The problem really is for the many repair facilities that are unwilling or unable to look at or accept the need to find new ways to define their value proposition other than ‘we do quality work’ slogans,” Schulenburg says.

One Big MSO?

Will everyone eventually become part of a MSO? “Never say never,” says Gange. The likely scenario for metro areas, he believes, is a small operator occupying a market niche based on location, technology skills or a specific certification/vehicle manufacturer.

“Growth-oriented operators who want to stay in the business will value a relationship in which they can access the infrastructure of a large, multi-store network that understands how to drive performance, which is the vehicle for continuing to expand their operations,” Gange says.

In addition to all the other factors, Bulbuck highlights the advantages of economic scale as a plus for MSOs in the collision business. “Because of the traction of consolidation, you see financial capital being attracted to the industry, whether through a public capital structure like ours or private equity capital like we saw with Carlyle Group’s acquisition of Service King (in 2012) or OnCap’s acquisition of Caliber Collision Centers (in 2008).”

Grimshaw says such purchases show that the buyer believes Caliber is a well-run organization, has a No. 1 or No. 2 position in every market its operates, and is well-positioned to grow both organically and via acquisition.

Does this mean the MBAs and CPAs will take over the industry? “All of economics is run by them,” Bonner chuckles.

Do-It-Yourself DRPs in Mississippi

Independents are missing a golden opportunity by not taking a ȁ