There are more than 15.5 million trucks operating in the U.S., and 2.2 million of those are tractor-trailers (truckinginfo.net). There are another nine million RVs on U.S. roads as well. Add in the vast number of buses, construction equipment, emergency vehicles, municipal and other government vehicles, and you get a significant amount of potential commercial refinish work out there.

Just how much? The U.S. Department of Transportation now estimates that more than 500,000 truck accidents occur every year. It’s no wonder that traditional “vehicle refinish” body shops are looking to expand into the commercial business.

National Survey

Examining this trend, BodyShop Business, in a study commissioned by Sherwin-Williams Automotive Finishes, recently conducted a national survey of U.S. body shops to see if they were tapping into the vast heavy-duty marketplace.

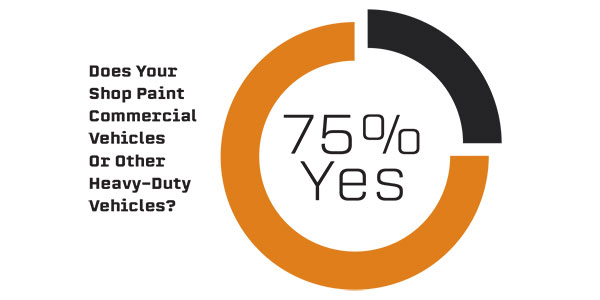

The survey was sent to BodyShop Business readers who were either body shops or repair facilities that also do body work. First, they were asked if their shop painted commercial vehicles or other heavy-duty vehicles. Three out of four shops said yes, they do some work on commercial vehicles.

Those who said “yes” were then asked a second question: “Does repairing/painting truck/fleet, commercial, municipal and/or agricultural, recreational vehicles or trailers make up at least 10% or more than $100,000 of your shop’s annual business?” Approximately 56% of the respondents said yes.

While more than half of the respondents indicated they were clearing more than $100,000 annually (or at least 10% of their business) from commercial work, the overall quantity of their business in this market was markedly limited. The survey attempted to quantify how many commercial vehicles they painted every month, and almost two-thirds of the respondents said they did less than 10 trucks or commercial vehicles per month.

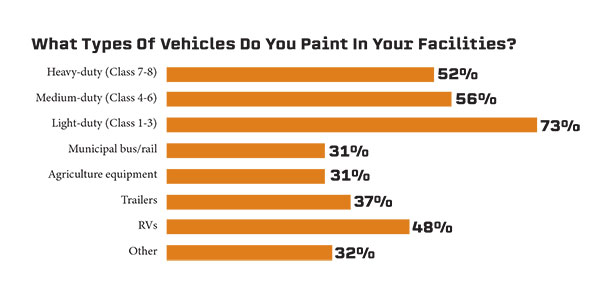

The responses did indicate that shops were doing a wide variety of commercial work: 75% doing light duty (Class 1-3); about 50% doing larger medium-duty (Class 4-6), heavy-duty (Class 7-8) and RVs; and 33% doing some trailers, municipal bus/rail and agriculture.

Nick Dowling, product manager, Commercial Finishes, Sherwin-Williams Automotive Finishes, notes that body shops that make an investment in equipment, training and service expansion can see a significant increase to their bottom lines.

“The size of the overall commercial market is dramatically expanding,” says Dowling. “While during the pandemic you saw a decline in vehicle repair and refinish, the increase in commercial work was substantial. Remember that all these fleets, delivery vans and municipal vehicles were all running out there every day. And the importance for fleet customers to get their vehicles back on the road — because they make no money when they’re sidelined — means they’re willing to pay top dollar for top repair work.”

Types of Work

What types of commercial business are available for shops?

Commercial repair and refinish opportunities abound in every metro, suburban and rural body shop area if you look for it:

- Delivery vehicles: traditional services like FedEx, UPS, DHL and now Amazon

- Food and beverage distributors: Coca Cola, Pepsi and Frito Lay

- Local repair services: heating/plumbing, landscaping and contractors

- Over-the-road Class 7, 8 tractor trailers

- Municipal buses and other government vehicles

- Emergency and first responders: police, fire and ambulance

- RVs and trailers

- Agriculture equipment

- Taxi cabs, rideshare and rental cars (typically lower margin, but high-volume work).

Finding the Work

Where do you find and/or attain commercial business?

“Having a highly visible location in proximity to commercial accounts is a huge advantage,” says Mark Kauffman, franchise owner and general manager of Maaco Collision Repair and Auto Painting in the Greater Minneapolis-St. Paul area. “For example, we’re out by the airport and very visible to several fleet managers. Location helps us get a lot of business out of those fleets that are already there servicing airport/airline accounts, and we’ve subsequently picked up a lot of business right on the airport grounds ourselves — things like luggage carts and other service equipment there.

“Another option is word-of-mouth, of course. Fleet managers are under tremendous pressure and need a shop that can meet their production turnaround needs. When they hear what our turnaround capabilities are, we make a good impression.”

Greg Downer, general manager of Referral Collision in the Twin Cities, agrees with Kauffman. He says his business has grown exponentially because of referrals, especially in the commercial sector.

“We called on fleet maintenance managers, or they heard of us, because previously they had some bad refinish experiences with other shops that made mistakes or took too much time on repairs,” says Downer. “In this business, that’s the ultimate no-no. Trucks stuck in shops are not on the road making money. The absolute no. 1 rule in commercial refinish is productivity and turnaround.

“So, while we’ve seen some declines in ‘traditional’ VR [vehicle refinish] business due to COVID, you have to realize that all these trucks have to keep on running all year long. Every community has loads of municipal vehicles, big fleets and delivery trucks. We have two big Amazon distribution centers near us, FedEx and other delivery vehicles, and they all need to be maintained. Some of the other commercial business like trailers and RVs — and there’s a lot of it — are a bit more seasonal.”

What’s Different About Commercial Refinishing?

Kauffman points out that commercial business accounts provide hourly rates that are much higher than standard insurance jobs. The challenge is adjusting your teams and work patterns to provide superior turnaround (remember, the no. 1 rule is that commercial accounts always need their vehicles back on the road).

“One of the real keys is that most of these fleets and municipalities are all self-insured, so they’re direct, customer-paid jobs,” Downer says. “You can deliver on the price point the customer expects, and that often means better revenue. Also, you can charge more for heavy-duty repairs and refinish, because there’s not as much competition and because the customer expects (and needs) better turnaround production. This is viable, because these vehicles take up a lot more room in the shop as well as the investment you’ve made in equipment, staff training and commercial repair expertise, and you can charge accordingly.

“Finally, from an administrative standpoint, this work is more streamlined, especially for parts procurement. It also isn’t as rigid when you’re doing normal collision repairs that have a lot of stipulations that insurance companies often mandate.”

Accommodations

Recognizing the potential of heavy-duty work, Kauffman transitioned a dysfunctional, 8,000-square-foot center with obsolete equipment and under-trained staff to a 15,000-square-foot location with state-of-the-art equipment and more than $2 million in annual sales.

“You have to have a large booth to do large repairs,” he says. “Our higher roof allowed us room to lay out the facility to fit increased commercial needs and eventually have the room and door height to add a truck booth and two lanes dedicated to trucks.”

Like Kauffman’s shop, Referral Collision also invested in a larger booth that is 18 feet tall, 65 feet long and 14 feet wide with 16-foot-high doors. This allows the shop to do vehicles like ProMasters, transits and Sprinters all the way up to box trucks and tractor-trailers.

Like all repair work, it still comes down to your team and its capabilities.

“It’s a little bit of trial and error when you first start on these larger vehicles — fiberglass knowledge is a must — so it takes regular body techs a bit of a learning curve at first,” Downer says. “We also invested in getting scissor lifts so we can reach larger, longer areas that need to be painted, and it took a little while to get the hang of that.”

Coatings

Refinishes for commercial vehicles can be a lot different than for light-duty vehicles.

“Because of the durability of finish commercial vehicles require — their over-the-road mileage exceeds passenger vehicles by more than 10:1 in most cases — they require topcoats that are extremely robust,” says Bruce Hale, general manager of JayMac Body & Frame, a division of Young Trucks, in Canton, Ohio. “You typically will need to put in an additional system — such as a polyurethane coating — but it is so worth it. We use Sherwin-Williams Genesis; it lays down real nice for a polyurethane and is worth it when it comes to finishing larger, commercial vehicles. You want a commercial finish that holds its gloss, has strong film build, is easy to mix and spray, and is quick and efficient. Time is money, as you know, when dealing with this business.”

Adds Sherwin-Williams’ Dowling, “Commercial vehicles need a topcoat that shouts ‘durability.’ The performance of a coating is paramount. Also, color match in the survey came up as important. For a lot of fleet customers, their livery is their brand – and while it’s imperative they get their vehicles back into service ASAP, the color and look of their ‘rolling billboard’ is oftentimes just as important.”

Kauffman uses a separate Genesis commercial paint system alongside his other vehicle refinish paint line. “We put this system in because it goes on fast and is extremely durable. It also works because they have specs for most national fleets, so it pretty much assures color match.”

Summary

A traditional vehicle refinish body shop owner can realize significant revenue increases and gain market share by tapping into the commercial refinish business. It takes drive, ambition and a financial commitment in shop equipment and manpower. It also takes looking at shop processes in a different manner in terms of project priorities, touch time, production turnaround, and administrative and insurance relationships.

With enough effort and perseverance, many traditional body shops can reap the benefits of the ever-growing and profitable commercial refinish marketplace.