This article is the third in a series on accounting and financial management. To read part 1, “Demystifying Body Shop Accounting”, click here. To read part 2, “The Squeeze is On”, click here.

Setting up a profit and loss statement (P&L) for a body shop may seem cumbersome, but once an owner understands a few key strategies, it becomes simple — and then allows management to focus on running the business.

To set up the P&L, it’s important to understand the different types of expenses and where they should fall on the financial statement. Knowing the difference between costs of goods sold (COGS) and overhead expenses is important for body shop owners because it gives them the ability to create a P&L statement that’s accurate and precise.

For many reasons, having a clear layout of the P&L for the business is necessary. It gives management and ownership the roadmap of financial performance and helps with understanding the financial health of the business. Further, understanding the chart of accounts aids in creating an accurate P&L statement. Chart of accounts is basically the buckets or categories where expenses are assigned. For example, a technician’s payroll expense is separated from the office supplies purchased so that management can review expenses correctly. A high-level look at the business separates out the COGS from the overhead expenses. All bills/invoices are either entered or coded to one of these two categories. A little later, we’ll take this a step further and get more detailed within those two overall categories.

COGS

The first set of expenses we’ll talk about is COGS. These are expenses that are associated with the repair of the vehicle.

When a vehicle is dropped off at a repair facility, an estimate or repair order is created in the operating/estimating system (Mitchell, CCC, etc.) to plan out the repair. When you make decisions such as replacing a part or repairing the damage, you’re choosing a category of revenue — labor, parts, paint and materials, etc. You order the parts or assign labor hours based on that decision, and the repair begins.

The expenses are also broken out between categories — labor, parts, paint and materials, etc. Typically, at the end of the month, the sales and costs are exported into the accounting system (Quickbooks, Xero, etc.), where the sales and some repair order costs are accounted for. Any expense that is part of the repair should be categorized as a COGS item. A rule of thumb is to add an expense category for each sales category. So, if you have sales in labor, parts, paint, sublet and towing, the P&L should also have those exact expense categories. Let’s take a look at what a suggested P&L should look like.

P&L

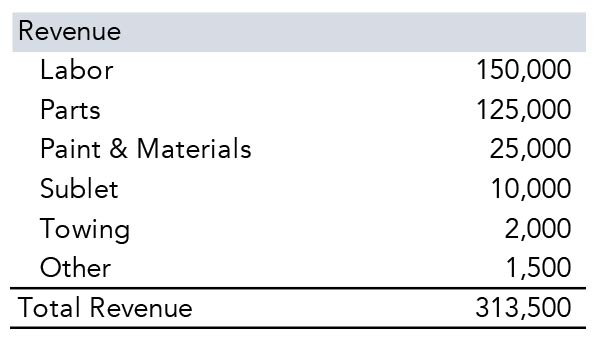

We’ll start with the sales categories. The sales should be broken out into a minimum of six different buckets — labor, parts, paint and materials, sublet, towing and other. It should look like Figure 1.

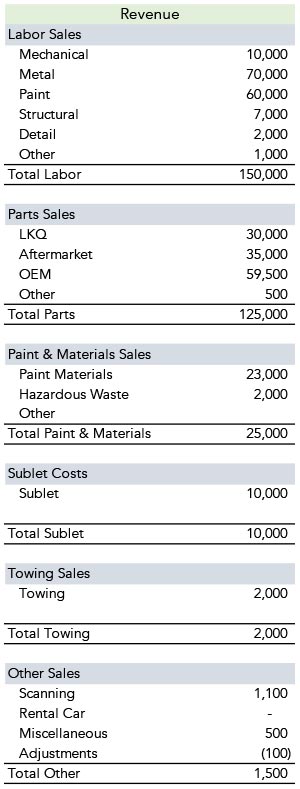

This is an example of a standard collision P&L. Management can add or delete any category it chooses. All estimating systems have the capability to categorize sales and expenses; however, the owner decides if he or she wants them mapped. Within each sales category, there are subcategories, but they do not need to be broken out on the P&L statement. Having too many lines would be unnecessary for the format of an income statement. An example of the detail within each sales item is Figure 2.

This should cover most general ledger accounts a body shop P&L should contain. However, management can pick and choose whatever information it would like the financial statements to include.

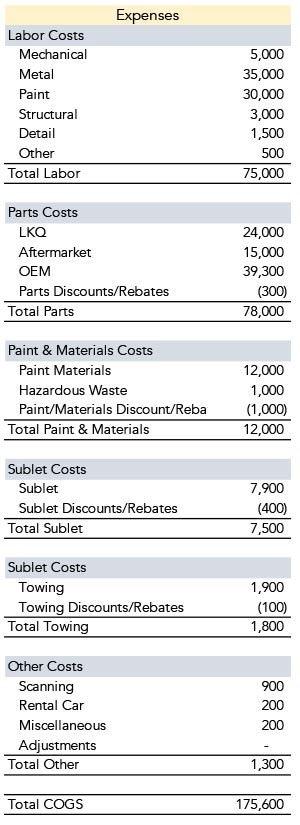

Now that we have the sales categories covered, we can dive into the COGS that go along with those. As mentioned above, COGS are expenses directly associated with sales. For example, if 10 hours of labor sales are assigned to the estimate, the flip side of those sales should show the shop’s cost for those 10 hours. The same goes for parts. If there is a sale for an original-equipment manufacturer (OEM) part, there should be a cost for that OEM part. An easy way to understand this is: if the expense is a direct cost to complete the repair, it is a COGS expense. This way, management can understand where the shop is making money and where there are opportunities to make more. An example of COGS on a body shop P&L looks like Figure 3.

Just like sales, each category of cost contains subcategories that make up the overall expense. A more detailed account of the expenses that go into the COGS categories can look like Figure 4.

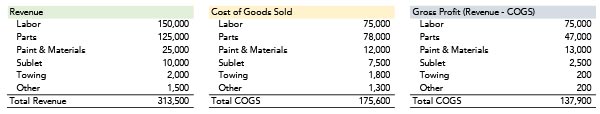

If you compare both sales and expense categories side by side, you’ll see that each sales category has an expense tied directly to it. This gives owners and management an easy way to examine and report profitability by sales categories and provides a roadmap of the financial health of the repairs that are completed in the shop. If you know what profit margins you want to make, it quickly shows where the shop is making profit and where there is opportunity to make more (Figure 5). You can quickly scan the sales and costs and how much money you’re making on repairing the vehicles.

It’s important that we don’t want to muddy the gross profit margins by assigning overhead expenses to the COGS buckets on the P&L. As a reminder, overhead expenses are things like rent, customer service representative (CSR) or manager pay, electric bill, estimating system, etc. Think of these as expenses you would have even if you did not fix one vehicle.

We’ve explained COGS and how they should land on the financial statement. Aside from having the sales and costs of goods sold mapped or coded correctly, having your overhead expenses coded correctly is important as well. Creating specific general ledger accounts for expenses helps categorize expenses into “buckets.” This is done in the accounting system the shop utilizes, not the estimating system as we did for sales and some COGS accounts.

Overhead

Now, we need to get into all the other expenses that are required to keep the business going, i.e. overhead expenses (also called operating expenses). There are various other expenses that each shop will have. There is no set way to title those expenses; rather, you should just follow the norm for the industry. Some shops will have very few and some will have many categories of expenses; either is okay. Figure 6 is a basic example of what overhead expense categorization looks like on a P&L.

Overhead expenses include payroll and benefits for all employees who are not directly repairing the vehicle, building expenses such as rent/taxes/utilities/building maintenance, office and shop supplies, advertising, meals, uniforms, etc. You’ll notice that while it is necessary to pay these expenses, they’re not tied to the actual repair of the vehicle. We need to pay rent and utilities to have a place to repair vehicles, but we’re not charging our customers/insurance companies for these expenses or making money on those items. A rule of thumb is that if the expense isn’t somehow “touching” the vehicle, it’s an overhead expense. For example, the parts and paint and materials are going on the vehicle, the technicians are repairing the vehicle, and the sublet and towing vendors are all involved with the repair. So, we refer to these expenses as associated with running a business that can’t be linked to creating or producing the repaired vehicle.

Summary

The sum of all the information reported should be an easy, user-friendly P&L statement for any collision shop owner to follow. A standard example of what a P&L should look like is Figure 7.

It’s a simple and direct way to report the financial health of the body shop. It clearly shows sales, COGS, overhead expenses and profitability. With this information monthly, owners and management can understand sales, how much money is going out and how much they’re making. With clean P&Ls, identifying leakage is a breeze. It allows owners and management to make better business decisions and the ability to recognize opportunities.