State of the Industry 2006

involvement and not enough business expertise on the part of shop

owners are all contributing to the sorry state that is the collision

repair industry.

When repairers are discussing the state

of the collision repair industry, I’m always reminded of something a Massachusetts shop owner said:

“You get what you tolerate.”

A successful multi-shop owner, he went on to explain that if you’re not

happy with how you’re being treated by insurers that, “perhaps the

insurance people are just doing to you what you’ve demonstrated that

you’ll put up with.”

His point? If you let insurers (or anyone, for that matter) walk all over you, they will — and gladly.

His theory supports what I’ve been thinking for years: The collision

repair industry is suffering from “victim-itis.” Many shop owners

believe that insurers control the rates, control the repair process,

control their businesses and control the industry in general. They

believe they’re being victimized — and that the insurance industry

doesn’t let them make a decent profit.

Doesn’t let them?

Sure, these shop owners may be victims, but only of their own distorted

thinking. The insurance industry doesn’t owe the collision industry a

living. Insurers are in business to make money (and they do), and so

are you. If you aren’t making money, then you only have yourself to

blame.

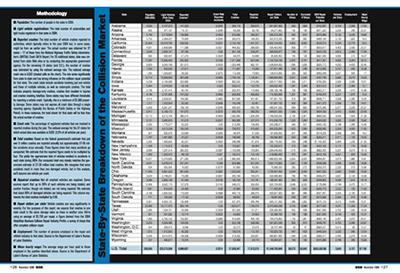

State-By-State Breakdown of the Collision Market (Click HERE for PDF)

State-By-State Breakdown of the Collision Market (Click HERE for PDF)

Many repairers have been suffering from this victim-itis for some time

now, and they’ve been able to get away with it simply because there was

enough work to sustain the marketplace — and to sustain most of the

shops in the marketplace.

But that’s all changing. Like so many industries before it, the

collision repair industry is evolving — for better or for worse and

whether you want it to or not. Consider the following facts:

- Fewer crash reports are being filed with police.

- Fewer claims are being filed with insurers.

- More consumers are “cashing out” instead of getting their damaged vehicles repaired.

- More collision-damaged vehicles are being totaled.

- More stability-control/crash-avoidance systems are being installed

in vehicles, and crash-avoidance systems are now in development that

could someday, literally, prevent cars from even hitting one another.

And none of the above even takes into account all the crap that goes on once a shop finally does get to bid on a job.

One word sums up the current state of this industry: sorry. Too many

shops, not enough work, not enough profit, too much insurer involvement

and not enough business expertise on the part of shop owners are all

contributing to the sorry state that is the collision repair industry.

Just the Facts

The facts are this: According to the National Highway Traffic Safety

Administration (NHTSA), more cars are on the road today than ever

before, yet fewer auto accidents are being reported to police — about

half a million less than in 2002. But NHTSA doesn’t believe the actual

number of fender benders has decreased — just fewer people are

reporting them.

How are your third quarter 2006 gross sales compared to third quarter 2005 (Click HERE for the PDF)

How are your third quarter 2006 gross sales compared to third quarter 2005 (Click HERE for the PDF)

In addition, drivers are also reporting fewer crashes to their

insurance companies — a four-year, 15% drop — which means less work for

body shops and record profits for auto insurers like State Farm and

Allstate. (Allstate’s net income rose 13% in the first six months of

this year.) Nobody knows precisely why less auto claims are being filed

with insurers, but it’s likely due, at least in part, to fear of

retribution: Consumers fear a raise in their premiums or even being

dropped by their insurer if they do file a claim.

Third quarter 2006 GROSS SALES Compared to 2005 – by DRP Affiliation (Click HERE for the PDF)

Third quarter 2006 GROSS SALES Compared to 2005 – by DRP Affiliation (Click HERE for the PDF)

But these statistics are just a piece of a much bigger picture: Just

under 7 million crashes are reported to police annually but 27.5

million accidents occur annually, according to the government’s

estimate of total crashes.

These 27.5 million accidents, however, still don’t represent the actual

“repair pool” because several factors play a role in decreasing the

number of repair jobs out there — the first factor being total losses.

At a recent Collision Industry Conference (CIC) meeting, Lee Peterson,

training/marketing manager for Chief Automotive Technologies, said the

percentage of collision-damaged vehicles being totaled has risen from

about 4% in 1980 to 18 to 21% today. And he predicted it could hit 30%

within two to three years. Statistics compiled by the information

providers also show that 18 to 20% of all estimates are designated as

total losses, indicating that total losses continue to increase at a

rate of 3 to 5% per year. And, according to one of the information

providers, because estimators tend to under-designate totals, the “true

total loss frequency” is likely closer to 23%.

For our State-by-State Breakdown of the Collision Market, we’ve

designated total losses at 20%, meaning that of those 27.5 million

annual accidents, 5.5 million are total losses — decreasing the

available “repair pool” to 22 million.

The next factor that plays a role in decreasing the repair pool is

“cashing out” — vehicle owners taking the insurance check but not

getting the vehicle repaired. Because that money is theirs, they can

legally do whatever they want with it. They can have all of the vehicle

repaired, some of the vehicle repaired or none of the vehicle repaired.

Word is, “cash-outs” are increasing. But trying to determine the “true”

cash-out figure is like trying to get your arms around a samurai.

State Farm, Allstate, GEICO and Progressive all told BSB that they

don’t track this figure (and one insurer employee admitted that even if

they did, they probably wouldn’t tell us). Their lack of information on

this topic was suspicious, to say the least, especially since at least

one of these insurance companies counts on cash-outs:

“Progressive’s whole business model is based on the cash-out, which is

why they lowball estimates so bad,” says a Connecticut shop manager.

“They know their customers are very likely to never get their vehicles

repaired, so if they write lowball estimates up front, they save

billions every year. Progressive’s business model has heavily

subsidized the big screen television market and Carnival Cruise lines,

since a large part of their claim dollars ends up in the pockets of

these and similar industries.”

Regardless, without the insurance industry’s help, this cash-out figure

remains elusive. Some speculate the percentage to be as high as 40-55%

in some markets with some insurers. But if we consider all insurers and

all U.S. markets, the figure is likely closer to 10-20%.

For our research, we’ve designated 15% of wrecks as cash-outs (15% of

27.5 million total annual accidents = 4.125 million. Subtract 4.125

million, along with the 5.5 million total losses from 27.5 million),

shrinking the total annual “repair pool” to just under 18 million.

Current Industry Atmosphere

And those are just the facts. We haven’t even taken into account the

collision repair market’s current atmosphere — which continues to

become more and more cutthroat. Many shops are desperate for work, and

desperation often goes hand in hand with bad decisions. There are shops

in the market willing to do anything to get jobs, even if what they’re

agreeing to is short-sighted and detrimental to the long-term health of

the industry.

Because we don’t have the time or space to discuss all of the issues

affecting the industry, we’re going to briefly take a look at a few of

the most serious problems:

symptoms of this one underlying problem: too many shops and not enough

work. At IBIS 2005 in Switzerland, a presenter indicated that the

number of shops in North America is forecast to be reduced 40% by 2010

— that four out of 10 collision centers will be gone by 2010. (To

compound this prediction, during hallway conversations at NACE 2005, a

North American insurance representative indicated that due to this

overcapacity, he believes labor rates are poised to decrease over the

next four years.)

People have been predicting the consolidation of this industry for

years now. While some predictions are more extreme than others, the

fact is: When it’s all over, there will be fewer shops.

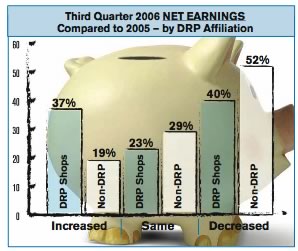

Third Quarter 2006 NET EARNINGS Compared to 2005 – by DRP Affiliation (Click HERE for PDF)

Third Quarter 2006 NET EARNINGS Compared to 2005 – by DRP Affiliation (Click HERE for PDF)

Until then, this over-capacity market — too much supply (shops) and not

enough demand (repair jobs) — presents lots of opportunity for abuse by

insurers, since shops are desperate for work. There’s tremendous

pressure to gain volume through discounting in an environment where

facilities are below capacity, and this discounting pressure will

continue until facilities begin producing work for a price below what

it costs them to generate that work. This “losing money on each job”

will continue until all cash resources and financing avenues are

exhausted and the capacity imbalance is equalized — when the affected

facilities go out of business.

“If we can get a supply and demand correction, pricing will be fair and

shops will be able to make a good bottom line. But we need enough

supply to fill our shops. Right now, there are too many stores,” says a

Kansas multiple-shop owner, adding that he believes State Farm’s new

DRP agreement “will accelerate getting that correction done.”

State Farm is currently sending 65% of their auto claims to shops in

their network. Insurer steering of work has reached epidemic

proportions, and it’s made possible by the fact that there’s always a

shop out there willing to cut insurers a deal, thus creating incentive

for insurers to steer.

Because this “deal making” isn’t going to go away anytime soon (as long

as there’s an over-capacity market), shops need to understand state

laws as they relate to steering, the insurance contract, the difference

between first- and third-party claims and so on.

This will not only help you recognize what insurers can and can’t do,

but it will make it possible for you to do some steering of your own.

You, too, can have a “preferred” list — of insurance companies — and

try to steer vehicle owners to the insurers you feel settle claims more

fairly.

It’s also important to mention here that shops have gotten lazy since

the advent of DRPs, making them even more susceptible to — and reliant

on — insurer steering. Too many sign on and simply wait for insurers to

send them work. They no longer market their business to the community,

making themselves completely dependent on insurer whims. Shop owners

need to become salesmen again.

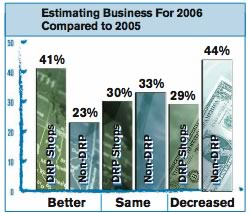

Estimated Business For 2006 Compared to 2005 (Click HERE for PDF)

Estimated Business For 2006 Compared to 2005 (Click HERE for PDF)

work — Because many shops rely solely on DRPs, they’re at the mercy of

insurers. And these “super DRPs,” such as Progressive’s Concierge

program and GEICO’s RX program, are only going to make the situation

worse.

Insurers with such programs shut down all the other DRP shops in a

market and direct all the work into one shop. These shops then become

almost exclusive with the insurer because most of them don’t have the

ability to quickly increase capacity to handle the new volume and

retain their other DRPs.

These insurers can then squeeze you even harder because you can’t say

no — they’re 90 to 100% of your work, so you can’t afford to lose them.

Shops need balance in their customer base or they’re at risk of

catastrophic losses. Yet shops will specialize — and are specializing —

in one insurer’s work.

This situation reminds me of something a Florida repairer once said:

“The relationship of the insurer/vehicle owner and the repair shop is

like a bacon-and-egg breakfast. The chicken is involved, but the pig is

committed. So before you walk over to the trough, make sure you know

why they’re fattening you up.”

“no” — There are no laws anywhere that give labor guides or insurance

adjusters authority over prices. Yet many repairers don’t see it that

way. A Montana shop owner once said that he was certain he’d be charged

with fraud if he overrode the labor database on one of his estimates.

He thought he was breaking the law if he priced his own work.

It’s the job of insurance adjusters to give up as little money as

possible. In the process, they often distort how the labor guides are

supposed to work — or they’re so uninformed that they don’t know how

the guides are supposed to work (and they have a vested interest in

remaining “uninformed”). It’s your job to charge what you need to do

the job right and to make a fair profit, regardless of what the

“guides” say.

After all, the labor guides are just that — guides.

And it doesn’t matter what the adjuster says other shops are willing to

accept (especially since adjusters have been known to lie about what

other shops are working for to get you to accept a lower rate, thus

setting a precedent that hurts the entire local market).

Says one Pennsylvania repairer: “As long as shop owners believe the

labor guides and third-party payers are holding them back, they’ll miss

the obvious: It is they who have done themselves in. Shop owners have

forgotten how to say ‘no.’

“Making matters worse, insurers see to it that body shop owners

cannibalize one another. If one digs in and says no to a low bid by an

insurer, there’s always another shop owner willing to dive at that low

ball.”

financial decisions without a thorough understanding of how that

decision will affect their business from a profitability and cash flow

perspective. So in an area where few businesses apply a sophisticated

cost/benefit analysis to financial decisions, many shops say “yes” to

bad business deals because they don’t fully understand what that

decision will ultimately cost.

This year was particularly tough on shops without solid business

skills. Fed up with repairers giving discounts to other, smaller

insurers, State Farm overhauled its Service First program — now called

Select Service. The new agreement requires participating repairers to

give State Farm the lowest rate for every labor or parts discount

category, free storage, free total loss handling, etc., etc.

“If you choose to give no discounts whatsoever, that’s perfectly fine

with us,” says George Avery, one of the architects of State Farm’s new

agreement. “But if your business model includes some discounts, then we

want to be part of it.”

But instead of seeing this as an opportunity — an opportunity, for

example, to raise rates with other insurers and to use the new State

Farm agreement as the reason — most shop owners simply agreed to the

contract and discounted their prices to State Farm, even though many of

them were barely getting by before, when State Farm work was

profitable.

Says a California shop owner: “We need to become numbers crunchers —

better business people with profit-driven guidelines.” For example,

when an insurance company asks you to participate in a labor rate

survey, “put your current non-discounted rate on the survey,” he says.

“Don’t think that by showing a discounted rate you’ll somehow get more

work. It will only establish the guidelines you’re allowed to charge on

the cars you do get — and force other shops in the area to work at a

lower rate too.

“We continue to do whatever the insurance companies want, and it has

come back to bite us — all because we were willing to agree to anything

for more cars. A contract needs to be beneficial to both parties. Our

current DRPs aren’t. They’re one-sided, in favor of the insurance

industry — and we only have ourselves to blame.”

Says a Kansas multiple shop owner: “The shops that understand their

numbers, supply and demand, efficiency and economies of scale, will

prevail. Better, faster, cheaper is what both the insurance industry

and consumers are demanding. Shops need to figure out how to deliver

this.”

standard operating procedures (SOPs) — “We’ve got to be able to deliver

a more consistent quality product in a dependable, timely fashion.

Today, as an industry, we aren’t very predictable. Process change will

drive that,” says an Ohio multiple-shop owner, referring to shops

needing to implement SOPs and to how the current process most owners

use to operate their shops is outdated — it’s not built to deliver low

cost, it’s not built to deliver speed, it’s not built to deliver

predictability. Yet that’s what today’s customers want.

“Most shops believe the answer to their problem lies in growth,” says a

“lean” shop owner in the Midwest. “It’s the, ‘If we could just fix one

more car per week we could make some money’ scenario. The problem is

that doing more (for them) raises their operating costs equally, if not

greater. If they had a good business process, they’d be making money at

current revenue levels. My concern is that these guys will make deals

to get the additional volume from insurers, which will only delay the

inevitable — their going out of business.

“The only way for all existing shops to remain is for them to control

costs so that they can make a profit at current revenues — with the

understanding that current revenues will decrease. There are just going

to be fewer wrecks to fix.”

Although only a small percentage of collision repair shops in this

country have implemented “lean” manufacturing principles, the ones that

have contend that it’s possible to deliver everything a customer wants

— quality, service and speed, at a lower cost — and to greatly increase

your profits.

“Individual efficiencies don’t matter one bit,” says a Pennsylvania “lean” shop owner.

“It’s the overall process — the process efficiency — that we need to

focus on, how the pieces work together. If I can improve the

relationship between all the steps, then the whole thing should flow

more smoothly. And the faster it flows, with the same overhead cost,

the more cash it generates. That’s where the real profit lies.

“If it’s a faster process, then your cycle time is also greatly

reduced. But it can only go faster if there are less mistakes — if

things are done right the first time — which means quality improves

too.”

Whether you buy into “lean” or not, the fact remains: You can’t do what

you’ve always done and still be successful when everything else around

you has changed.

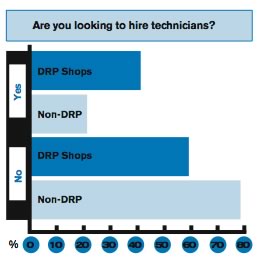

Are you looking to hire technicians? (Click HERE for PDF)

Are you looking to hire technicians? (Click HERE for PDF)

insurers isn’t policyholder satisfaction. It’s shareholder

satisfaction. Stock value is paramount. Senior level management move

quickly through the organization (six-month to one-year terms in a

position), so decisions are often based on moving metrics quickly, with

no long view of performance.

Says a shop owner with multiple DRPs in place: “Goofy programs are put

in place to achieve a short-term movement in some silly number that

someone has justified. And shops are forced to do these silly things

that have, in most cases, no value to the customer — but do increase

operational expense.”

Shops could manage these requirements effectively if they stayed

around, but the problem is that they always disappear and a new program

is developed. Says an East Coast shop owner: “Rarely in these

organizations are the customers more than an afterthought, i.e.

Progressive and Allstate. Allstate was so bothered by their

policyholders that they fired all their agents a few years ago and made

them independent from the company. In their opinion, if they didn’t

have all these pesky customers to deal with, they could get something

done.

“What’s worse, these guys never get the right measurements. You have to

be careful in putting measurements out there for people to hit. You get

what you measure. For example, the im-portant measurement for an

insurer is the average cost of claims (severity), but they can’t talk

about it because they can’t, by law, set the price of repairs. So they

use measurements they call ‘severity drivers,’ things like the

percentage of alternative parts used on repairs or the total average

number of paint hours per repair.

“The truth is that you can hit all these targets and still have a

higher severity. Adversely, you can have lower severity (a good thing

for the insurer and vehicle owner) and poor performance against the

measurements. This ultimately can get you thrown off the program. You

wind up getting shit from one hand of the insurer and praise from the

other. Nothing good can ever happen.

“We need to get the right measurements on the table. Insurers spend so

much money inspecting shops’ work (reinspectors have reinspectors, have

reinspectors …) that if they could just get the right measurements

out there and trust the shops, we could put 100% OEM parts on cars and

insurers could increase their profits.”

claims to have standards but no one is held to them,” says a California

shop owner.

Since the advent of the automobile, this has been a problem for the

industry. Back-alley shops that do cheap repairs and crap work have

given this industry a black eye that it still sports today. Then came

DRPs, which only made the situation worse. Shop owners (who lack

business skills) often sign onto programs that limit their shop’s

ability to produce proper repairs. So now we’ve got back-alley shops

and profit-depraved mainstream shops performing crap repairs.

Crap repairs are easier to spot. It’s quality repairs that prove elusive.

“The problem with trying to define ‘quality’ in our day-to-day dealings

is that even if there is a precise definition, it’s open to

interpretation by almost all who participate in the repair process —

the vehicle owner, the estimator, the insurance adjuster, the body

technicians, etc,” says a Georgia shop owner. “The ‘quality’ issue is

even further complicated by ‘locally acceptable quality.’ This

misconception is that the level of repair quality in a particular

geographical region is dictated by what the ‘acceptable’ quality level

is in that area.”

How deficient is overall body shop repair quality in the United States?

Post-repair inspectors (PRIs) report seeing proper repairs about once

out of every 100 inspections. “Shops’ practice of putting out slothful

repairs is commonplace regardless of geography,” says an Ohio PRI,

adding that because post-repair assignments often come from attorneys

who are working bodily injury claims and because DV usually isn’t

considered on vehicles with minor damage, PRIs are often inspecting

heavy hits. “There’s no question that heavy hits are harder to repair,”

he says. “Regardless, quality isn’t graded on a curve.”

shops are losing the war on attracting, training and retaining

technicians. The easy way out is to hire experienced techs from

somewhere else, which is what most do, rather than taking the steps

necessary to participate in the long-term solution to this challenge.

“When you hire an already-employed technician from in or around your

hometown, you’re ‘raiding,’ plain and simple,” says a Missouri shop

owner. “It’s counterproductive. “The prominence of raiding tells me

that most shops don’t have a clue as to how to bring new help into the

industry. It’s becoming clear that, at some point, shops are going to

have to start growing their own. Stealing from other shops isn’t going

to fill the shortage.”

While complaining that they can’t find good technicians, many shop

owners are turning away entry-level candidates because they only want

to hire experienced techs.

“Shops need to start working closely with area vocational/technical

schools and community colleges, and they need to do so year-round, not

just when they need new employees,” says a Virginia shop owner, adding

that shops also need to establish a mentoring/apprenticeship program

in-house that will help them “grow” these entry-level techs into

experienced journeymen.

The industry also needs to stop letting tool costs and entry-level pay

be a deterrent to recruiting and retaining new people. Shops hire an

entry-level person and expect him to buy tools at the low starting

wages they pay him. Let’s see, food and shelter, or tools? Most are

going to take food and shelter — and go work at the fast-food joint

down the street instead, for the same wage.

Even with decent entry-level pay, the tool investments needed are huge.

Although most shops — and techs — aren’t yet open to the idea, some of

the more progressive shops have begun supplying tools to their techs.

“Our facilities are fully tooled — specific tools at point-of-use in

specific areas of the shop,” says an Ohio multiple-shop owner. “We

don’t need multiple tool sets within the shop, and techs don’t need to

spend all that money on redundant sets of tools, especially entry-level

people. This is a major culture change from the subcontractor mentality

that exists in shops today.”

focus was on collision safety (side airbags, etc.). Today, the focus is

on collision avoidance (sensors in bumpers that detect impact in

parking, braking systems that automatically slow your vehicle when

sensing rapidly reduced distance between you and the car in front of

you, sensors that detect brain beta wave functions that sound alarms if

you begin to fall asleep).

“I used to believe that there would always be wrecked cars, but that

may not be the case,” says one veteran shop owner. “There are vehicles

now being built that are impossible to wreck. Vehicle systems can be

designed to never let cars hit each other or anything else.

“Also, what about Chinese vehicle imports? Can these guys build cars so

cheaply that you just throw them away when wrecked? They’re talking

about new cars for 8 grand. At what price are they totaled? Think about

other things that used to be major purchases (TVs, refrigerators,

etc.). Do you have these things fixed today, or do you just go buy a

new one?”

YOU Control Your Destiny

It’s been a tough year, and it doesn’t look like it’s going to get any

easier in the near future. That’s why the decisions you make right now

are so important.

Regardless of your shop’s size, success will come to those of you who

learn how to work on your business rather than in your business. To do

this requires a change of mindset. It means accepting that, as a shop

owner, you don’t “fix cars” for a living. You run a collision repair

business — which involves fixing cars, but it also involves a whole lot

more.

Getting a handle on that “whole lot more” is what’s going to separate those of you who succeed fr

How are your third quarter 2006 NET EARNINGS compared to third quarter 2005? (Click HERE for the PDF)

How are your third quarter 2006 NET EARNINGS compared to third quarter 2005? (Click HERE for the PDF) Do you feel you have the ability to charge regular rate increases? Are insurance companies trying to lower or control rates? (Click HERE for PDF)

Do you feel you have the ability to charge regular rate increases? Are insurance companies trying to lower or control rates? (Click HERE for PDF)