A San Diego County Superior Court jury found on April 22 that Wawanesa General Insurance Company breached its contract by attempting to repair a severely damaged vehicle that should have been totaled. The plaintiff, Marcus Benning, was awarded $24,000 in property damage.

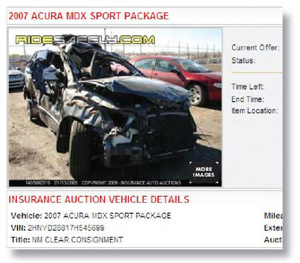

Before the accident, Benning’s vehicle was worth $37,000. Approximately $30,000 was spent on repairs performed by the insurer’s DRP shop, and after repairs, the vehicle was found to have a value of $16,000 and was potentially unsafe to drive. The potential salvage value before repairs was about $7,500.

If Wawanesa had totaled the vehicle, it would have had to pay by law the cash value of the vehicle along with the appropriate sales tax, or $40,000, but it could have recovered the salvage value, or $7,500, along with the deductible of $500, so the net costs to Wawanesa would have been $32,000. By repairing the vehicle, with Benning paying the deductible toward repairs, the net repair costs were $29,883.11. Therefore, Wawanesa saved $2,116.89, plus collected insurance premiums during the five months the vehicle was in the repair shop. Since the cash value of the vehicle along with sales tax was $40,000, and after repairs was worth $16,000, Benning lost $24,000, in addition to the loss of his vehicle for five months.

According to Montie S. Day, attorney for the plaintiff, Wawanesa testified during the trial that this claims handling practice was its approved practice, and admitted it would continue the practice. Day also said that Wawanesa officials stated that as long as they could make $1 by this practice, they would repair the vehicle without regard to the financial interest or concerns of the insured.

Day also reported that Wawanesa said it did not and would not report the accident so the title would be clean and thus Benning could recover his diminished value losses if he sold the vehicle. Benning reportedly refused the offer because he didn’t want to be dishonest. Day says evidence at the trial indicated that the DRP shop did not report the damage to the vehicle, but the CARFAX report revealed that the vehicle was at the shop for “vehicle service.”

During the trial, Day contended that the insurance industry uses certain tactics to maximize profits without regard for the safety of the public, including “title washing,” whereby a vehicle is taken by the insurer and sold at a salvage auction to people who will repair it. The vehicle is then moved to a different state, re-registered as never having been damaged or in an accident, and then sold by dealers or individuals to an unsuspecting buyer. The effect, Day said, is to increase the salvage market, which increases profits to insurers because they can recoup higher prices for damaged vehicles. According to Day, roughly 1 million vehicles undergo this process each year.

Day also contends that insurers advise victims of car accidents in which the vehicles have sustained diminished value that they can privately sell their vehicles without disclosing to unsuspecting buyers that the vehicles sustained frame and structural damage.

A case decided Aug. 22, 2010, in which Day acted as plaintiff’s counsel, involved a seller who sold a vehicle to a buyer after concealing a serious accident. Day recovered $8,250 actual diminished value plus $33,000 in punitive damages and court costs.

“Advising insureds that they have no ‘diminished value’ for their repaired, damaged vehicles because they can sell the vehicles themselves and have no duty to disclose to the buyers that the vehicles have been in serious accidents is not only ‘grand theft’ but immoral,” said Day.

More information:

Diminished Value: Fact or Fiction?

Oregon Supreme Court Decision Puts Insurer on Hook for Diminished Value