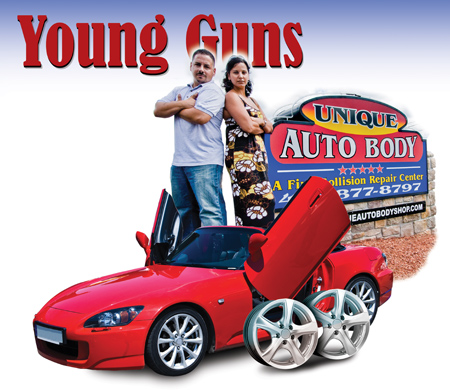

When you sit down and talk with body shop owners Ray and Clare Santiago, you hear them discuss clothing lines, reality television shows and Internet marketing. The subject of fixing cars almost never comes up, although that’s the main service their shop, Unique Auto Body of Fallston, Md., performs.

When you sit down and talk with body shop owners Ray and Clare Santiago, you hear them discuss clothing lines, reality television shows and Internet marketing. The subject of fixing cars almost never comes up, although that’s the main service their shop, Unique Auto Body of Fallston, Md., performs.

And then you hear their take on insurance companies and things really become surreal.

“Why would insurance companies want to pay full price?” asks Clare, who serves as Unique’s CFO and public relations manager. “Nobody wants to pay full price in this world, and the same goes for insurers.”

And then it hits you. Clare is 30, and her husband, Ray, is 31. This radical perspective on the way insurance companies conduct business and these wild ideas on business diversification are the products of a couple of young, stupid kids who don’t know any better because they haven’t been around for 20 or 30 years like some shop owners. At least that’s been the feedback they’ve gotten at industry roundtables.

But before others cast their own judgement, the Santiagos plead with them to consider that they never experienced the good ol’ days when net profit margins averaged around 20 percent and insurance companies cast nary a scrutinizing eye at estimates. They were only small children when shop owners first bought in and signed on to fledgling DRP programs. In their view, they’re trying to do the best they can in an industry that was shaped by others and handed to them pre-packaged, at the same time trying to bust out of that package and reshape it to their benefit.

By all accounts, they’ve already been successful at doing that. After starting out eight years ago in a small, leased space and grossing $40,000 their first year, the Santiagos have turned that into $2.1 million performing not only collision and mechanical repair but selling used vehicles and customizing cars. They have state-of-the-art equipment, including a three-dimensional laser measuring system, a professional, clean building with a plasma TV, fireplace and leather couches in the reception area, and platinum and gold certifications from I-CAR. They also have a slick Web site which offers, among other things, a virtual tour of the outside and inside of their shop.

And then comes the crazy stuff: a reality show focusing on the trials and tribulations of running a body shop along with managing their relationship as husband and wife, currently being looked at by a casting agent; a customized uniform line for body technicians; and an international reputation for high-end custom installation of grilles, tire and rim packages, smoked taillights and custom crystal emblems and decals, as well as fender rolling and custom wheel alignment.

These are the things that the Santiagos envision for themselves one day as a safety net in case they like other shops lose DRP work. Because despite being about 18 years younger than the average shop owner, they aren’t naïve enough to believe that can’t happen.

Compromise Is Key

The Santiagos’ youthful charm doesn’t make them immune to hard-nosed insurer business practices that other shops experience, such as being told “you’re the only one who charges for that” or “we’ll only pay you the prevailing labor rate.” Still, they prefer to look at it as insurers doing what they need to do to run a tight ship and try to keep from displaying toward them the vitriolic hatred some longtime repairers do.

“I talked to one old-school shop owner who doesn’t even let an insurance adjuster in his shop because he said by law he doesn’t have to,” Clare says. “He said, ‘I’m 65 and I’ve been in this business for over 30 years and I’m tired. And I said, ‘You look tired. Why? Because you’ve given up the fight. All you’re doing is covering up your ears and refusing to hear anything about DRPs.’

“If Ray and I had our way, there would be no DRPs, but that’s not the reality of this world. The insurers aren’t going anywhere.”

Unique Auto Body is on several DRPs and, according to the Santiagos, has thrived by achieving outstanding Key Performance Indicators insurers look at when grading a shop on its performance. But that doesn’t mean Ray and Clare are completely happy with how the system works. They’re in full support of an A-B-C shop classifying system which would enable “A” shops to be rewarded with a higher labor rate for meeting certain equipment, training and customer service criteria.

“The way we look at it is if insurers can offer rewards plans for policyholders, why can’t they do the same for repairers?” Ray says. “You’re telling me my numbers are really good, so give me something back.”

But the Santiagos are firm believers in negotiation, not war. They refuse to draw a line in the sand like other repairers but instead believe working together with insurers in a positive way will lead to benefits for both parties. They believe too many people are too quick to make enemies of everybody versus pulling together for the greater good.

That approach takes a lot of honesty and compromise and accepting blame where blame is due. A classic example is when Ray questioned one insurance adjuster on her refusal to pay for something. He told her that his estimator told him she had OK’d the procedure, but she said she had told the estimator that decision was contingent upon certain conditions. In addition, she said the estimator never gave her supporting documents or photos before moving ahead with the procedure. So Ray ended up eating the cost and the estimator learned a valuable lesson.

“We’ve gone round and round with insurers, and sometimes they eat it and sometimes we see their point and we eat it,” Clare says. “It’s about compromise, whether it’s a relationship with an insurer, a business partner or a spouse. Ray and I haven’t been married for nine years because we don’t compromise.”

But there are times when compromise only goes so far. The Santiagos are businesspeople first, repairers second, and if a relationship with an insurer no longer makes sense because the profit is no longer acceptable, they will walk away. One fleet account wanted the Santiagos to offer a rate less than what all of their other DRPs were receiving, plus 15 percent off each ticket. Another insurance company Unique had worked with since opening started writing its own estimates and insisting that the shop follow them exactly as written. In both cases, the Santiagos decided to part ways, knowing that volume doesn’t always equate to profitability.

At a Glance: Unique Auto Body

Shop: Unique Auto Body

Location: Fallston, Md.

Owners: Ray and Clare Santiago

2007 Gross Revenue: $2.1 million

Square Footage: 9,000

No. of Employees: 8 – 1 office manager, 1 estimator/production manager, 1 parts manager, 1 painter, 3 collision technicians, 1 painter’s assistant

Service Mix: 70% collision/mechanical, 25% used car sales, 5% customization

Can’t Stop Steering

The Santiagos say that ever since they dropped the aforementioned insurance company, they haven’t seen a single job from them – proof positive, they say, that steering exists. But they don’t believe there’s a whole lot they can do about it.

“The claims rep gives the consumer the spiel about how they can’t guarantee the repairs of a shop not on their program and ‘you may have out-of-pocket expenses,’ then at the end say ‘but you have the right to go to the shop of your choice,’” Clare says. “That’s never going to stop. Are we the little shop owners going to change this by lobbying? Probably not. The only way to change it is to join them and figure out a better solution.”

Which is why the Santiagos have been thinking of extreme ways to promote Unique Auto Body’s brand and try to get consumers thinking about their shop before they get in an accident. That’s one of the goals behind trying to get a reality TV show, which they filmed a pilot for and posted on YouTube. They want to give consumers an inside look at the challenges of running a collision repair business and educate them on their rights.

“We want to get across to consumers that they have to right to choose their own shop, that it’s our shop that offers the lifetime guarantee and it’s our shop that will negotiate the best price for the repair and not charge them more than they’re willing to pay,” Clare says.

The Santiagos also spend about 6 percent of their revenue annually on advertising, preferring the Internet over print media. Their page on MySpace, a social networking Web site, cost nothing, and their actual Web site (www.auniqueautobodyshop.com) was built by a friend who traded his Web design services for custom work.

To promote their customization business, Unique Auto Design, the Santiagos have formed relationships with local professional athletes, finding deals for them on luxury cars and then customizing those cars, always including their logo on the front windshield. Clare had the inside track on one athlete – Kosta Koufos, a high school basketball phenom who was the 23rd overall pick of the Utah Jazz in the 2008 NBA Draft and is her first cousin.

“When those cars sit in the players’ parking lot, the other players check them out and ask who we are, what do we do and what kind of deal can we get them,” says Ray. “Once they come in to get rims put on, they also know that if they ever get in an accident, they can go to the shop of their choice, and they’ll pick our shop because Ray took care of them. That’s how you get more clientele.”

What’s Wrong With DRPs?

The majority of the industry believes the current DRP system needs to be reformed. And there are a growing number of disgruntled non-DRP shops who have either been kicked off DRPs, voluntarily given them up or refuse to sign on to any that believe the DRP shops, or in their minds the shops that are “giving everything away,” are ruining the industry. The non-DRP shops also say that all DRP shops cut corners and do poor repairs because that’s the only possible way they could make a profit. But Ray takes issue with this, citing the superior equipment and training his shop and employees have.

“For one insurer’s program, I had to purchase a three-dimensional measuring system,” he says. “I know a guy down the street who still uses a concrete pole, a come-along and a dozer. He just eyes it up and doesn’t measure anything. I have all the proper equipment, I repair cars well and I sleep well at night.”

Adds Clare, “People say if you’re in bed with DRPs, you’re not profitable. But DRPs have taught us how to become more efficient, to repair versus replace when appropriate and to consider aftermarket or recycled parts in some instances, where there’s more of a markup.”

The irony, the Santiagos believe, is that it’s the older generation that created the problem, not them. They say they inherited it, and now must make the business decisions they feel are necessary to get by.

“The older generation frowns on us for wanting to work with insurance companies, but we didn’t cause the problem,” Clare says. “We want to help the situation and negotiate.”

Clare recalls one incident with an insurance company that her shop did not have a relationship with that didn’t want to pay Unique’s walk-in rate.

“I told the customer that I wasn’t going to hold up her claim and inconvenience her for the way her insurer was handling it, and so I just negotiated with the insurer,” she says. “The older generation doesn’t see it like that. They see it like, ‘How much can I get?’ That’s the difference between us and them.”

“Insurers are on guard because a lot of shop owners want to overwrite estimates and commit fraud, so I can’t blame insurers for being careful, they’re just doing their job,” she adds.

Dumping all DRPs is not the solution, the Santiagos reason. It goes without saying that a start-up shop today with no reputation or history would simply have to grab every DRP it could to get going. They’ve seen too many shops take an anti-DRP approach and then have to scramble to supplement the shortfall.

“Sometimes it takes new school thinking to change the way the old school has been thinking,” Clare says. “By kicking these insurers out and telling them to get lost, they’ll go to Joe Blow down the street who isn’t nearly as qualified as you who’s going to take the work. The insurers are always going to find someone else to do the work, so why can’t we all join together to stop that and set a standard for the industry?”

Nothing to Lose

The Santiagos are hoping their business philosophy and diversification plans pay off in the future. If it doesn’t, they’re prepared to start another type of business. The way they figure it, they’re young and have nothing to lose. They certainly won’t try to just get by if things aren’t working out, which is what they see some shops doing.

“I want to tell those shops, if you can barely make it, why are you still in it?” Ray says. “Maybe you should have made changes throughout time to get out of the industry.”

The Santiagos believe there will be a reduction in the number of shops in the future and those left standing will be in good shape. And they feel Unique Auto Body will be one of them. Says Ray, “The strong will survive, and the insurers will determine that by cycle time, proper equipment, etc.”