I was recently with a group of younger industry folks who were discussing the use of non-OEM sheet metal. As you’re well aware, many insurers are now insisting that some percentage of crash parts used in repair are new, non-OEM parts. My impression in reading the various insurer score sheets is that 15 percent aftermarket parts is the average goal. Having been in our industry since 1970, I’ve been present for their rise, fall and rise again.

Patch Panels

In the 1960s, there were no look-alike crash parts; the only alternative to new OEM or salvage OEM parts were patch panels. These were stamped steel panels that were “universal” in shape. You would buy an appropriately shaped stamping that the body shop cut and welded (or brazed) into place, primarily to repair rust damage. Dog-leg shaped, rocker panel shaped, wheel arch shaped and just plain flat sheet metal hunks were among the choices to fix rusted out cars.

I worked summers for my dad and grandfather whose auto parts business also sold PBE items. As I type this article, I can still see two scars on my hands from loading and delivering those patch panels. Because they were casually stamped from heavy gauge sheet steel, the edges of the panels were sharp as knives. “Wear leather gloves,” other employees told me. Because I was 16 years old, I knew I was smart enough not to get cut. Right!

Rust Problem

My recollection of the initial appearance of sheet metal stampings shaped “exactly” like the fenders was in response to a rust problem, too. Late 1960s and early 1970s GM pickup trucks had front fenders that rusted out every year – at least on the salt covered roads in the Midwest. At the time, our industry had a parts pricing structure called “wholesale comp,” which enabled everyone who touched the crash part to make good money. Typically, the body shop’s gross margin on new OEM American sheet metal was about 40 percent. In addition, the dealership that sold the part to the body shop made a healthy margin. As a result, the two annually replaced pickup fenders cost the consumer about $240 each. It might have been OK once, but the poor truck owner would have to do it again the next year.

Some enterprising soul took a new GM truck fender to the Pacific Rim and found a local “manufacturer” to stamp out a part that looked close to the OEM version. These replacement parts still rusted out every year in the early ‘70s, but another one was only $75 instead of $240. As the copycat process became more and more common, it ultimately ended the wholesale comp pricing structure. Car manufacturers could no longer compete if everyone who handled the part made a fortune on it. I can remember my ’70s shop customers saying they wouldn’t work on Volkswagens because they could only make 20 percent gross on those parts and could make a full 40 percent on Chrysler, Ford and GM crash parts. Wholesale comp finally ended for good in the early 1980s.

Fit Issues

Those initial aftermarket crash parts suffered from severe fit issues. The flanges were often not correct, the side maker light holes were off, the tabs were in the wrong place, etc. It was those issues that were at the root of the famous aftermarket crash parts court case in Illinois.

In 1998, a group of consumers sued their insurer for repairing their collision-damaged autos with substandard sheet metal parts. These folks claimed the insurer breached its promise to repair their damage with like, kind and quality parts that would restore their vehicle to pre-loss condition. Fearful that their customers would sue them, too, other insurers soon stopped requiring that shops use aftermarket crash parts.

Needless to say, the insurer appealed that verdict. As the court cases ground on, many folks (me included) predicted the decision would be overturned. If the U.S. courts held that any non-OEM car part was insufficient, it would put the entire aftermarket auto parts industry out of business. No Champion sparkplugs in your Ford, only Motorcraft plugs. A huge segment of the population (one in five people) had jobs with an auto industry tie. If only the car manufacturer could replace parts (they would be happy campers), but without competition, the car companies could charge whatever they wanted for the only possible legal replacement component.

Use of aftermarket sheet metal fell to less than 5 percent of the auto body market immediately following the Illinois court’s decision and the many subsequent appeals. Once reversed, the industry’s use of non-OEM sheet metal once again rose to 15 percent of the crash parts market. Insurers continue to be interested because those look-alike parts are a lot cheaper than the factory components.

In my experience, the body shop’s objections to those parts was two-part: first, the knock-off part was not an exact and correct copy of the OE part, and the extra labor time to move the incorrect tabs, cut or fill the maker light holes and generally modify the A/M part to fit suitably could not be included on their RO. Insurers wanted to pay only book flag times for the R&R operations. Second was the money issue. If the OEM part was $100 and the body shop made a 25 percent gross profit, they were ahead $25. If the aftermarket part was $70 and the shop made a 30 percent gross profit, they were ahead only $21, a big difference in shop net at the end of the year.

Having built a couple of training programs about the aftermarket parts business, it’s my opinion that the quality of the non-OE crash parts has gotten considerably better. They fit much more like OE parts now. Body shops demanded it, and responsive vendors complied. The price differential continues to be an issue, of course. And at least one additional problem remains, I believe.

CAFE Standards

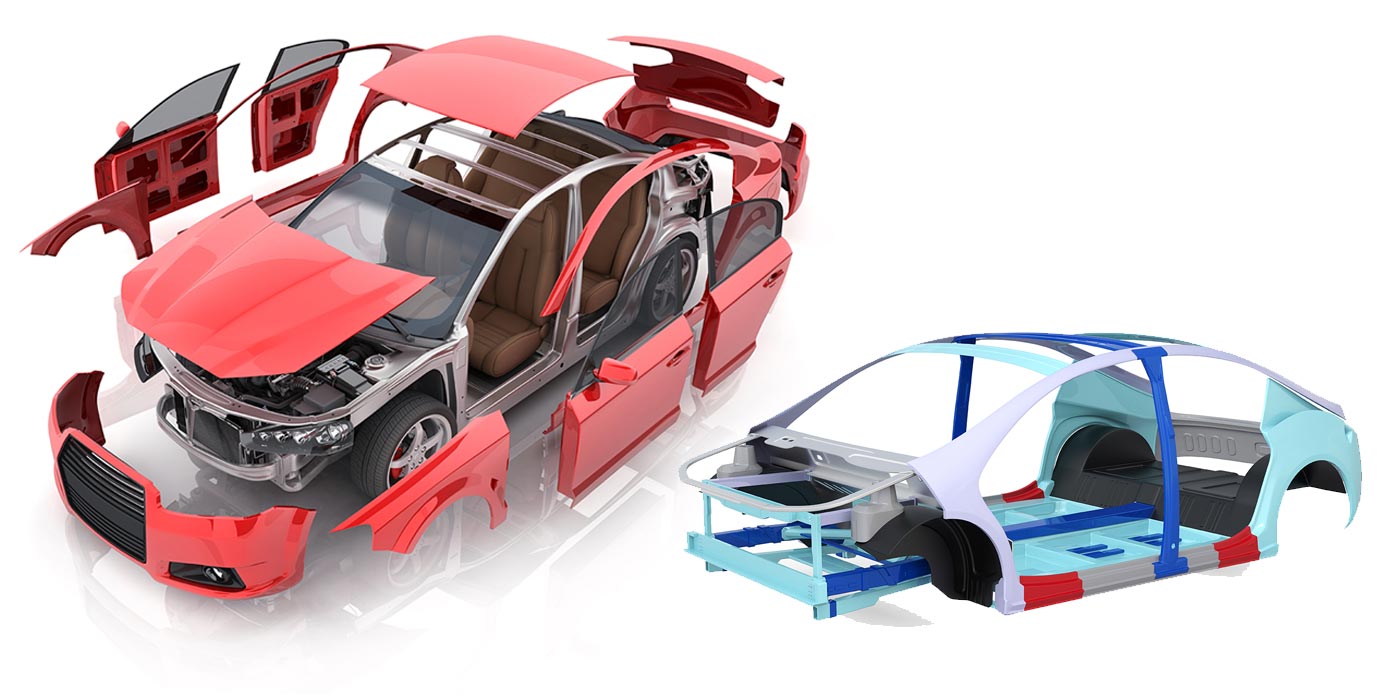

In an effort to meet Corporate Average Fuel Economy (CAFE) standards, automakers on every continent have made their engines smaller and more efficient, built unicoupe bodies instead of full perimeter frame vehicles and further reduced weight by using thinner gauges of sheet metal. By employing sophisticated metallurgy, they’ve even increased auto panels’ tensile strength while using lighter gauge, lighter weight, thinner sheet metal.

High strength steel, high strength low-alloy steel and boron-infused steel all allow the vehicle to weigh less while still protecting the occupant. Witness Ford’s expanded use of lightweight aluminum to improve the gas mileage on their trucks as an ongoing effort to improve their CAFE with lighter metal panels.

Unicoupe car construction, the three sheet metal box auto, is safer in virtually every collision than any full frame 1960s Ford Galaxie or Chevrolet Impala. But the occupant’s safety depends on the controlled collapse and energy absorption of the sheet metal boxes. The remaining question in my talks with the younger industry crowd about aftermarket sheet metal parts is the metallurgy involved. Is that look-alike part from China made from the same super sophisticated steel? Does it make a difference in the next collision?

Future Repairs

If your shop is in a DRP relationship with an insurer that demands that some percentage of their repairs be completed with non-OEM parts, will your reluctance to use them cause the insurer to choose another partner? Probably. Certainly not all vehicles currently have extra special high-strength steel parts. If future cars are all built with panels made from “unobtainium,” the Pacific Rim vendors will possibly make their look-alike panels from it, too. In the meantime, do what you must to deliver safe repairs to the consumer in a way that keeps the insurer (they pay for 90 percent of all collision repairs) happy.

Mark R. Clark is owner of Professional PBE Systems in Waterloo, Iowa. He’s a popular industry speaker and consultant and is celebrating his 26th year as a contributing editor to BodyShop Business.