Owning and operating a body shop is more expensive than ever. On top of the costs of personnel, training and equipment, shop insurance premiums keep going up – even if you haven’t filed any claims.

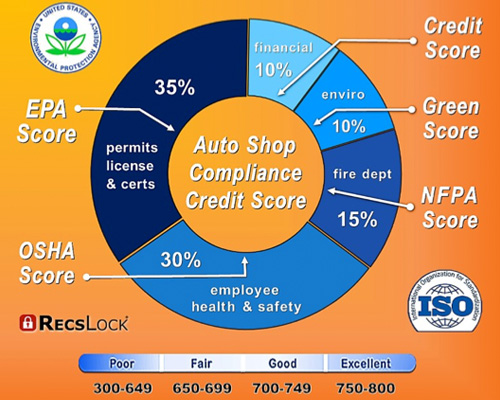

Fortunately, there are several things you can do to improve the chances that your insurance costs won’t outpace your ability to run your business. It starts with your compliance credit score, and you can get it free from a data analytics company called RecsLock.

Every shop in the country has a compliance credit score, a number of of companies – including automakers and insurers – are monitoring it.

A good compliance credit score has many benefits for a collision repair shop, including better chances for vendor credit; increased negotiating power; lower worker’s compensation rates; better employee retention; an absence of EPA/OSHA audits and fines; and lower insurance premiums.

George Avery worked for State Farm as an internal consultant for 31 years and was the chairman of the Collision Industry Conference for two years. He is a highly respected public spokesperson for the collision repair industry who makes presentations at number of industry conferences, including the upcoming Collision Industry Electronic Commerce Association Symposium in Tampa, Fla., scheduled for Sept. 17-19.

He has extensive knowledge from both sides of the industry –insurance companies and collision repairers – because he grew up in the body shop world before working for State Farm. Avery sees multiple benefits for shops that can stay compliant and knows that insurers will value it on many levels.

“This data is now in the cloud and available to so many more entities, [so] all of a sudden repair facilities are being judged more carefully for the way they fix cars and the way they comply with literally every aspect of their business,” Avery said. “It’s being monitored in a completely different way now and insurance companies are more discerning and only consider shops that have better numbers in these areas. It’s for the benefit of the insurance industry, the collision repairers and ultimately the consumer as well. Insurers want to know that they’re working with the best shops in their portfolio and this data can make that happen.”

Strategies for Keeping Insurance Premiums in Check

Here are some ways to save money on your insurance premiums and protect yourself from having to dig deeply into your pockets as rates rise.

First, preserve your permit history by maintaining a strong regulatory compliance record.

Your regulatory history is highly important to keeping your insurance premiums in check, so avoiding violations is significant. Things can happen, so if you do get a violation, minimizing the impact is vital. The old days of getting the help of a safety consultant to minimize the severity of a violation are long gone, so avoiding them altogether in the first place is more vital than ever.

Another method to achieve this is to protect your credit as well, because it also directly correlates to your insurance rates.

Insurance companies all over the country are now assigning risk scores to their current and potential customers, based on factors such as your years in business, permit history and credit scores. Insurance companies strongly believe that shops with poor credit scores will likely be less detailed with their regulatory documentation, so it’s all connected. This is illegal in some states – but not all of them – so consistently paying your bills on time is imperative to saving money on your insurance premiums.

Stay on top of your compliance all the time to avoid creating a poor track record that can seriously damage your insurance premiums.

Getting cited or fined for any violation can cause your score to plummet, just like if you miss a mortgage or car payment in the real credit world. Designate someone who is experienced and who you can trust to keep you in total compliance all the time and rely on them to keep your operation safe. You can have a pristine record, but one misstep along the way can put you in a bad spot rather quickly.

Establishing a comprehensive written safety plan is an ideal way to avoid problems down the road and likely be rewarded by insurance companies as a result.

You would be surprised how many top-notch shops don’t have a written safety manual. Obviously, insurance companies are extremely interested in reducing risk, so when they know that a shop has and follows a carefully documented plan, they will often reward it with lower insurance premiums.

In the end, running a compliant business that follows the rules will pay off on many levels.

If you get great scores from your DRPs and have an outstanding consumer service index, that is a great start. Shops that do the right things and are thorough in every area of compliance, logically don’t get fined and stay out of trouble. So, preserving your permit history is an important way to keep your shop’s insurance premiums in check. Some lose track of their permitting because they’re busy fixing cars and providing exemplary customer service, but that’s a mistake that can seriously impact you in many ways.

Overall, if you take these measures you may not significantly reduce your shop insurance premiums in a huge way, but collectively they can save you on your insurance overtime. If the funds are going into anyone’s pocket, why shouldn’t they be yours? Why give it to your insurer instead as opposed to buying that new piece of equipment that can help you to repair cars better and more efficiently or bonus your better techs for their excellent work? Establishing and working hard to establish a good compliance score can enable you to save money and bring you new business along the way, so yes indeed – regulatory compliance really does matter!