This article is the third in a series focused on how collision centers can benefit by working more closely with their PBE distributor to meet the demands of consumers and insurers. And, how distributors will benefit by more effectively responding to the needs of their collision customers.

In part two of this series, we discussed the importance of an effective inventory fulfillment process and its impact on increasing production. Another “core competency” for PBE distributors is to help collision centers improve paint and materials (P&M) profitability, one of the four profit centers of every collision center. This is accomplished by maximizing P&M sales and minimizing P&M cost.

While PBE distributors can help shops increase P&M sales through measurement and education, today’s mission is focused on how they can help reduce P&M cost in order to improve P&M profitability and increase output.

What is P&M?

While there is no absolute definition of what constitutes P&M, it is generally considered all of the paint liquid, abrasives, masking products, sealants, body plastic and other items customarily used in body repair and refinishing operations. Those items should be charged to a P&M cost account within cost of sales. Items commonly purchased from a PBE distributor but not considered P&M items include shop maintenance supplies, tools, hardware, booth filters, etc. These should be charged to a separate shop supplies account in overhead, not cost of sales. This distinction is important when we begin to measure P&M gross profit and P&M or paint cost vs. output.

What You Pay for P&M Items (Price)

Of course, everyone wants to pay as little as possible for everything they purchase. The collision industry is a competitive market on all levels, and the relationship between manufacturers, distributors and collision centers is no different. Since distributors are competitive in their markets, based on the certainty of volume and the competitive conditions in the market, most distributors are going to be within a few percentage points on “price” and will seek to differentiate themselves on service and other benefits.

Benchmarking Usage

The primary variable in the P&M cost equation is usage, or how much paint and allied products are actually consumed on a daily and monthly basis versus the shop’s output (i.e. paint hours produced). Distributors invoice shops when inventories are replenished, most often on a weekly basis, and tally it on a monthly statement.

Actual usage is affected by shop practices and technicians’ work habits. Waste is common: Over-mixing, over-application, redos and theft. Most distributors monitor their shops’ P&M purchases monthly in order to detect excessive usage trends. Many will take the next step and measure P&M or paint liquid purchases per paint hour produced for a more accurate measurement of usage vs. output.

Purchases are most often measured at invoice price, which may or may not include a discount. For this reason, it is difficult to benchmark these figures to gauge individual performance vs. an objective standard. Since about two-thirds of P&M cost is paint liquid, the easiest and most reliable measurement of usage in a collision center is to track monthly paint liquid purchases (valued at refinish pricing) per paint hour produced. “Paint purchases @ refinish” come from the distributor, so we know it’s accurate. The only number required from the collision center is paint labor hours. This is relatively easy to obtain from the body shop management system or from payroll, since most paint techs are paid based on production.

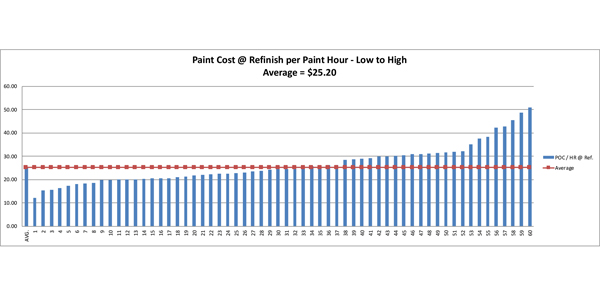

The graph above is real and represents a group of 60 shops across the country. Many are new at this tracking effort, and I would expect most to improve over time with continued measurement and a good faith effort to improve shop processes. Price has been taken out of the equation, so everyone is on a level playing field. Differences are all usage.

While the averages may increase over time due to inflation, the shape of the curve and the range of values are typical. The absolute numbers are less meaningful than other information contained in this graph.

There is always a group of “best-performing shops” (lowest paint cost). There are also shops spending more than average. From the chart above, you can see a range from $12.25 for the lowest cost to a high of over $50. While the overall average is $25.20, the average of the “best 25%” group was only $18.16, or 28% below the average.

The group’s average monthly paint hours are 748. If an individual shop with “average” usage ($25.20) was able to reduce it to the average of the best 25% group ($18.16), it would realize a reduction of $7.04 per paint hour or $5,266 in reduced monthly purchases or an annual savings of over $63,000 ($7.04 x 748 paint hours = $5,266 x 12 months = $63,192) – plus a proportional savings of allied materials! That’s a very meaningful savings for an average-sized collision center.

Every shop operates somewhat differently, and there is always an excuse for poor performance. However, objective data of hundreds of shops over many years suggests:

- Manufacturer/brand makes little difference

- There is a beneficial correlation by size of shop

- MSOs and dealerships tend to fare a bit better than independent shops

- All data groups have a similar range of good and poor performance.

- Across all groups, an individual shop’s internal practices and tech habits are by far the greatest determinants of performance.

- Causes of excessive paint consumption include:

- Over-mixing or mixing multiple times for one RO

- Over-application (excessive thickness of area painted)

- Redos (paint imperfections, wrong parts painted, etc.)

- Theft or side work

The first three also affect output (vehicles delivered) due to the fact that “whatever wastes materials also wastes time.” Each of those consumes time that could otherwise be spent repairing another vehicle. In addition to wasting time and materials, they extend cycle time and adversely impact CSI.

Reducing P&M Cost and Increasing Output

PBE distributors and collision centers must embrace proactive technical support and training. A fast response to solve a paint issue is not sufficient. We need to work together to enable technicians to be more self-reliant – to avoid problems and solve challenges when they occur.

First things first. Before any vehicle appears in a shop’s paint department, the shop must be clean and well-organized, equipment and tools must be maintained and function properly, and color tools must be up to date. Techs who work together and are organized in order to perform their functions correctly and efficiently are much more productive and less wasteful. Daily scheduling and goals should be in place.

Off-line processes. Apart from the daily flow of work, the shop’s repair planning process, along with shop standards, will make it clear what is to be repaired and what is not. Needed blending, or blend-within-panel repairs, and early identification of paint codes must be communicated in writing on the RO and on the vehicle itself. Color should be mixed and matched long before the vehicle reaches the paint booth, and if the shop employs a paint edging process, it must be completed without adversely affecting the flow of work.

On-line processes. If distributors and shop managers are able to focus on the above aspects, the daily flow of work (paint department staging, prep work, booth staging, paint application, cool down/de-mask) will move to and through the paint booth without delays. Daily output will increase, due dates will be met and CSI will improve.

Brainstorm ideas to impact the root causes of excessive usage (incomplete estimates, poor body work, lack of tool or equipment maintenance, miscommunication, etc.)

Summary

Reducing P&M cost is a team effort, but it will pay off in higher profitability and increased output. Next time, we will explore how to eliminate bottlenecks and deliver more vehicles per day.”

John Halstead is director of business support for the Refinish Distributors Alliance (RDA), a group of 18 independent PBE distributors across North America focused on delivering value to its collision industry customers and other refinishers. He has spent 27 years in leadership positions in the PBE industry with Superior Auto Paints, ProFinishes PLUS and National Coatings and Supplies. He also served for 12 years as a consultant, thought leader and training content developer for Collision Management Services in support of BASF, Toyota Motor Sales and numerous other collision groups. His prior background includes an MBA and 12 years with The Carborundum Company. He can be reached at [email protected]. To learn more about RDA, visit www.rda-impact.com.