We are at a pivotal moment right now. Yesterday, your customers were clients of insurance giants like State Farm, GEICO and Allstate, but the customer and insurer of tomorrow may be changing due to automated driving technology and more precise OEM repair procedures that are driving a shift in liability within the insurance industry.

There are two potential paths the future of auto insurance could follow: your customers could get a policy directly from their vehicle manufacturer, or they could be cut out of the insurance picture completely by autonomous vehicles which could make the OEM or software developer liable for malfunctions that cause accidents.

It makes sense in that OEMs already tell us how their vehicles need to be repaired, and so manufacturer-provided insurance may be the next step. They know how the cars were built and how they’re used (thanks to telematics data); how they must be fixed and what it costs; and now, maybe even how to best insure their vehicles.

Porsche recently announced it will be offering “a new breed of insurance” that is available exclusively to Porsche drivers. The company would offer custom policies based on the actual number of miles driven, which would be documented by customer-submitted photos. In addition, Porsche has made an attractive benefits package with its program including Porsche Genuine Parts, 30-day coverage for a luxury rental and diminished value coverage.

“Porsche customers deserve an insurance product that fits their lifestyle and their Porsche,” said Fred Blumer, CEO of Mile Auto, who partnered with Porsche to provide the mile-based insurance which aims to appeal to the commonly low-mileage Porsche driver.

At a time when following OEM procedures is essential due to growing liability, this could be a game-changer in terms of shops getting that scan or necessary OEM bumper covered by insurers no problem.

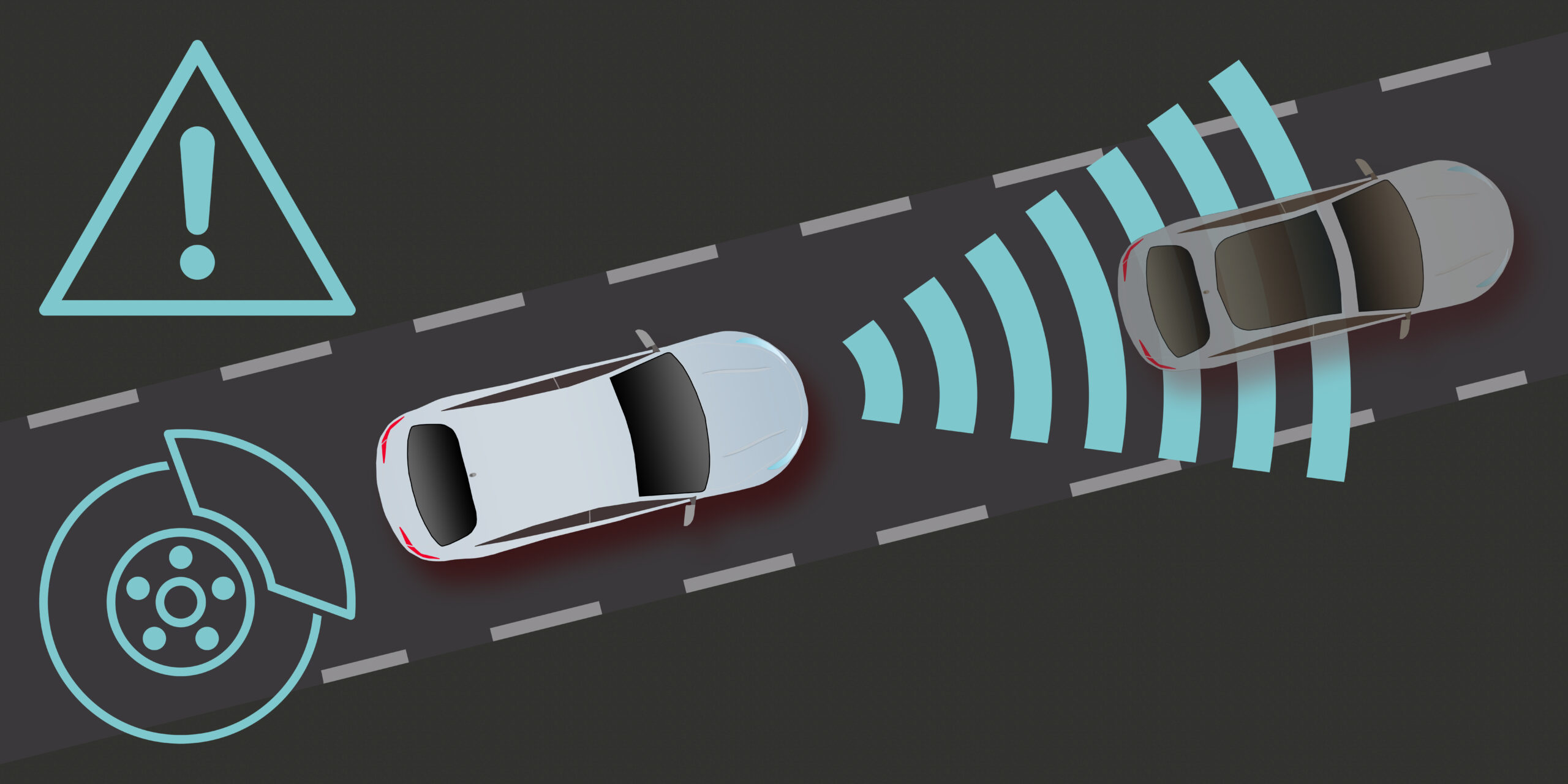

Meanwhile, OEMs that are working on autonomous technology either in-house or through a partnership could take a different path – one where the vehicle manufacturer is the policyholder and assumes liability for its autonomous vehicles.

David Ross Keith, an assistant professor of system dynamics at the Massachusetts Institute of Technology, predicts that insurance will become much less consumer-facing in the future due to technology.

At low automation levels (i.e. current driver-assistance systems), drivers will still be the policyholders in the near future, but once automation reaches higher or full autonomous ranges with no human involvement, it could mean insurers will be selling more policies to companies and fewer to drivers. Entities like car, software and sensor manufacturers are then going to be liable for the failure of their products rather than the driver’s negligence.

“As a society, we’ll have to figure out who’s liable for these different things and that will determine who’s required to insure against what risks,” Keith said in a Property Casualty 360 article.

The driver will no longer be the main risk factor. It’s a crazy thought and, again, shifts who you would be working with when a claim is filed to repair the cars of the future. This would force insurance moguls to re-evaluate their policies to suit the needs of the rise of increasingly autonomous vehicles in order to effectively insure them. If they don’t, it might be enough to push them out of the market, leaving it up to tech firms and manufacturers to insure themselves elsewhere.

The insurers of the future could come in many forms. It seems it’s not a matter of if it will happen, but when.