Ah, the labor rate. One of the most talked about, debated and scrutinized aspects of the collision repair industry. Why is it so low compared to other trades, and why has it not risen and kept pace with other professions? How can a mechanical service shop charge $100 per hour, while the average hourly door rate at a collision shop is a shade above $50?

We all know the answer: the presence and involvement of a third party in the business transaction between a collision repair facility and a consumer. That third party, of course, is the insurance company. Ninety percent of the time, insurers are paying the bill, so they’re only doing their job by trying to mitigate costs. The problem is when that effort to mitigate cost robs the body shop of the ability to make an acceptable profit and denies the consumer of a quality, safe repair.

NABR Launches LaborRateHero.com

The question is, can anything be done about it? With car counts down during COVID-19 and the discount-by-volume business model struggling, can the industry make strides in getting paid more fairly? If not, why are we talking about it? Down the rabbit hole we go.

Making Strides?

Although some believe the collision industry has made strides with regard to the labor rate, most believe it is still much lower than it should be.

Average National Labor Rates

Body & Refinish $59

Frame $73

Mechanical $94

Paint & Materials $38

(Source: NABR VRS Labor Rate Survey)

“Labor rates are still incredibly challenging in the industry,” said Aaron Schulenburg, executive director of the Society of Collision Repair Specialists (SCRS). “The reason is because you have two segments of the industry that have opposing objectives: insurers who are trying to mitigate costs to the greatest degree possible, and independent businesses providing services at a profit. And those two things don’t necessarily align, and it has impacted labor rates and the control insurers have over directing work and getting to consumers and being involved in the decision-making process.”

There are some things, however, that Schulenburg said shops can do to make up for it, such as distinguishing themselves in their particular market.

“A lot of that is internally making decisions on how you approach repairs – finding tangible ways to differentiate your business and maybe aligning with certification programs that promote a specialty, ensuring that you have to have the skills, training and equipment in order to do certain tasks,” Schulenburg said. “And those differentiated skill sets justify unique rates and associated charges.

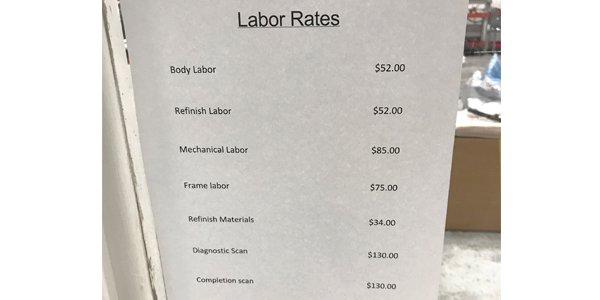

Sampling of Body Labor Rates Across the Country

$52 – Guthrie, Okla.

$60 – Madison, Wis.

$52 – Norwalk, Ohio

$48 – Staunton, Va.

$50 – Columbus, OH

$75 – Saratoga, Wyo.

$58 – San Bernadino, Calif.

$50 – Myrtle Beach, Calif.

$65 – Tyler, Texas

$48 – St. Albans, W.V.

(Source: BodyShop Business Facebook Page)

“What does my market look like? Customers? Vehicles? How can I distinguish myself as more than a service [customers] need but a place they have to go to get a proper repair?”

Another avenue to get properly compensated is sharpening your estimating skills and making sure to prepare a comprehensive blueprint and capture things that other shops miss.

“It’s good to be aware of what is in the estimating systems and be an expert on those systems to include not-included operations you may overlook,” Schulenburg said.

One place collision repairers who want to write estimates that accurately reflect the time it takes to do certain tasks can go is the Database Enhancement Gateway (degweb.org). The DEG was developed to help improve the quality and accuracy of collision repair estimates through proactive feedback from the collision repair industry and other “end users” to the information providers (CCC, Mitchell, etc.) that supply the databases for the various estimating products.

READ ALSO: Determining Labor Rates for Aluminum

“It’s a mechanism to become more proficient at estimating systems and capture missing operations and errors in there,” Schulenburg said. “Even if something is based on historical data, if the model has changed, you can

address that.”

Not enough repairers know about the DEG, and too few visit the website to make inquiries. Even so, repairers have made over 10,000 inquiries on the site. It’s very easy to do, and you typically get a response within 24 hours. The inquiry process follows these steps:

- Inquiry received by the DEG

- Inquiry submitted by the DEG to the information provider

- Information provider or DEG requests additional information

- Response/resolution received from the information provider

Compare and Contrast

Collision repairers like to draw comparisons between their average door rate and other trades’ rates to show how far behind they are, but some people wonder if that’s a pointless exercise because it doesn’t change anything. But Schulenburg believes holding up bodymen’s pay to other skilled laborers’ pay does have some merit.

Have You Ever Adjusted Your Labor Rate To Get Work?

Yes 59%

No 41%

(Source: 2019 BodyShop Business Industry Profile)

“Is it a viable point to point to other trades’ pay? Does it provide justification in consumers’ eyes? Does it help when in the process of dealing with legislation? Does it help to draw parallels to other industries that have seen increasing rates without a third party to suppress them? Yes, it’s a great parallel to draw and there is nothing wrong with that,” Schulenburg said. “Belaboring things that don’t move the needle for you, however, is counterproductive. Repairers need to ask themselves, what moves the needle in my business? What drives more profitability? There are a lot of mechanisms out there when you focus on what you do and what others don’t. Look inward and adjust your practices and find the things that work.”

A National Survey

Labor rates are Sam Valenzuela’s business. As founder of National AutoBody Research (NABR), he created the Variable Rate System (VRS) to help both insurers and body shops address labor rates – a critical economic factor in the health and sustainability of the collision repair industry.

Valenzuela believes there are two main factors that have contributed to the labor rate being suppressed: insurers and repairers themselves.

Do You Feel You Have The Ability To Charge Regular Rate Increases?

Yes 43%

No 57%

(Source: 2019 BodyShop Business Industry Profile)

“My family used to own mechanical shops, and we had full control over labor pricing,” he said. “In collision, there are some of the same things as mechanical, such as training, tooling, equipment and environmental regulations, but the biggest difference is the presence of insurers.

“If you look at any type of insurance, homeowners or health for example, insurers are doing their job in helping to keep their claims costs low. Their presence helps keep pricing in check, but in [NABR’s] opinion, it has been held down too much over the years. Labor rates in their current state are not sustainable – maybe enough to barely keep a shop alive but not thrive.”

But Valenzuela puts some of the blame squarely on repairers’ shoulders, saying that they don’t have a deep enough knowledge of their own economics and the key drivers of value and profit. Once you know that, he said, you then have to aggressively manage it and ask for it.

Calculate Your Labor Rate with this downloadable Excel spreadsheet.

“We’ve seen too many shops behave as if their labor pricing is what it is and they don’t have control over it,” Valenzuela said. “They believe if they raise their posted rate a few dollars, it won’t change anything for them because insurers still won’t pay more. It’s a learned helplessness. They can exert more control over pricing then they think, but we recognize it’s not easy.”

Steps Toward Change

The first step to solving the problem, Valenzuela said, is to try to change repairers’ attitude.

“The first thing is to start with one’s mindset. People have to believe that they can win this battle. If they don’t believe that, you’ve already lost, so why play the game? One’s attitude and behavior is critical.”

The second thing is making pricing transparent, Valenzuela explained. A good example is gas stations, where the price can be easily seen on a sign out front.

“Body shops’ labor rate is public information too – the posted rate, door rate, rack rate, price of labor, whatever you call it,” he said. “It’s important that pricing is transparent, and that’s where our Variable Rate System comes in. A big step toward a free market economy is knowing what prices are.”

The third thing is knowing who the customer is. Some shops believe that the customer is the vehicle owner, while other shops believe the insurer is the customer. Still others believe they have a dual customer: the vehicle owner and insurer. Valenzuela believes wholeheartedly that the customer is the vehicle owner.

“Whether it’s a DRP or non-DRP relationship, the customer is not the insurer,” he said. “When I take my car to get repaired, I owe that shop 100% of the bill. The insurer doesn’t owe the shop a penny. In practice, the insurer often pays on behalf of the consumer, but legally, once that customer signs the repair order, that is a contract between the consumer and the shop. The consumer then turns around to the insurer and says, reimburse me. Insurers are indemnifiers.

Certified vs. Non-Certified

The NABR survey found that the average posted body rate for mass-market OEM-certified shops and non-OEM-certified shops is $58.

“This says that if OEM-certified shops think their labor is more valuable than non-certified shops, that value is not showing up in their labor prices,” says Sam Valenzuela, founder of National AutoBody Research. “Or, said differently, from the perspective of what their price communicates about the value of their labor, OEM-certified shops don’t think their labor is worth any more than if they did not have any certifications. If they do believe their certified labor really is worth more, then their labor price is not communicating that.”

The average posted body rate for luxury OEM-certified shops is $63, a statistically significant difference from other shops.

“For what could be a variety of reasons, luxury OEM-certified shops price their labor higher, reflecting a higher value for luxury collision certified labor.”

“Shops are sellers, consumers are buyers, so it doesn’t matter what insurers say they pay in the market. What they are really saying is, this is the rate we reimburse our customers at. They are not saying this is the price we will pay for labor. It’s a bummer for the customer because they will get stuck with the bill. Many shops eat the difference, while some are getting better at collecting the difference from the customer. But remember who the customer is. More and more shops realize that and do a good job of having a formal process to set expectations up front.”

The fourth thing, Valenzuela said, is to remember that customer-pay is the best way to measure market price. Valenzuela believes that whenever a consumer pays for something, whether it be a computer, smartphone or the $100-per-hour charge at a mechanical shop, that is proof that they accept the price.

“When we look at customer-pay data in, say, Massachusetts, the prevailing rate, or what insurers say they’ll pay, is $38 to $40 an hour, the lowest in the country,” Valenzuel said. “But customer-pay data in Massachusetts averages in the mid-50s and goes as high as $95. A consumer paid that, which is proof of market price.”

Valenzuela contends that the more of that kind of data you have, the stronger the argument you have about the market rate.

“And then the next step is to translate that and say, why do insurers have the privilege of paying a rate lower than that? I don’t know the answer to that.”

Valenzuela acknowledges that all shops are different and have different prices. So what is the range of acceptable prices? Once a shop figures that out, shops can then operate in that range.

“And then hold their ground and enforce the market rate. If you have a special deal with an insurer for a discount on labor in exchange for volume, that’s a business decision. If you don’t have a contract, there’s no reason for a shop to have to accept a below-market rate or be forced to pay someone else’s contracted rate.”

Finally, shops need a repeatable process. Valenzuela said that his system is part of that, but it does not deliver a higher labor rate to repairers on a silver platter without their involvement.

“Shops need to understand what the right labor rate is for their individual shop, post the rate, change their profile in the estimating systems, fill out the NABR survey to make [the rate] visible to everyone, and write an estimate at that rate and enforce it. It can be difficult, but they have to do that.

“Just like a flywheel, it takes effort and torque to get it moving, but once it gets moving, it doesn’t take as much effort to get it moving.”

All Shops Are Alike?

As a former body shop owner and current owner of Auto Damage Experts, which has been providing automotive inspection and expert legal services nationwide since 1997, Barrett Smith knows well the inequity of the body labor rate. But, like Valenzuela, he believes shop owners are complicit in the problem.

“As long as insurers can hang their hat on the fact that ‘all body shops are alike,’ and all they owe is what the average shops charge – and as long as DRP shops oblige them – they will continue to use such arguments to take unfair advantage and receive the continued benefits of doing so,” he said.

Asked if there was anything repairers could do about it, Smith said his dream would be for every shop to list and receive ample compensation for each and every procedure, part and material.

One alternative, in his mind, is for repairers to abandon fictitious hours or “units” and start to charge a “procedural charge,” where they would simply list the service and charge a dollar amount.

Smith does not believe legislation or government intervention is the solution. On one hand, he sees mandates and requirements tied to advanced technologies that would encourage repairers to raise their prices, but he hasn’t yet seen that rate increase. Aluminum, he said, was the same way.

“The same thing happened with the introduction of aluminum in collision repair. Although repairers were forced to make substantial investments in equipment, training, certifications and specific space for aluminum repair, little in the way of elevating rates and allowances have resulted.”

Smith believes collision repairers in part are to blame for getting themselves in the “mess,” and likewise will have to rely on themselves to get out of it.

“The collision repair industry will be responsible to get themselves out of the mess which they and their forefathers have allowed themselves to get into,” Smith said. “It will begin by getting the education they need to see the big picture and the important role they play in it.”