The Automotive Service Association (ASA) applauds and expresses its gratitude to the U.S. House of Representatives for passing H.R. 7024, the bipartisan Tax Relief for American Families and Workers Act of 2024.

Introduced by U.S. House Ways and Means Committee Chairman Jason Smith (R-MO) and U.S. Senate Finance Committee Chairman Ron Wyden (D-OR), the bill passed the full house with 357 votes in favor and 70 votes against. If enacted, provisions in the Tax Relief for American Families and Workers Act of 2024 could provide much needed financial relief to ASA members. ASA urges the Senate to consider and pass this legislation as soon as possible.

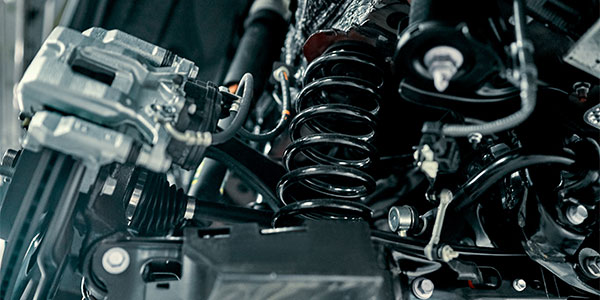

Independent automotive repair businesses are currently confronting a litany of unique pressures that undermine their potential to thrive. Rapidly advancing automotive technologies constitute one of the greatest challenges. To continue serving their customers, repairers have had and will need to continue to invest in costly facility and equipment upgrades. Some of these expenditures may require assuming debt. This tax proposal would:

- Reclassify interest paid on certain business loans as allowable deductions

- Provide for a 100% bonus depreciation allowance for qualified property — such as equipment and vehicles — acquired and placed in service between Dec. 31, 2022, and Jan. 1, 2026

- Raise the maximum amount a business may expense for qualifying property from $1 million (reduced by the amount by which the cost exceeds $2.5 million) to $1.29 million (reduced by the amount by which the cost exceeds $3.22 million), adjusting for inflation for taxable years after 2024

One provision in the framework of significant consequence to many repair business’ employees is the expansion to the Child Tax Credit. The bill would:

- Change how the maximum refundable credit is calculated by including consideration for the number of children in a household

- Increase the maximum per-child limit from $1,600 to $1,800 for tax year 2023, along with annual increases to the cap adjusted for inflation each ensuing year through 2025

“Advancing the Tax Relief for American Families and Workers Act closer to enactment is a huge win for independent automotive repairers,” said Bob Redding, ASA Washington, DC Representative. “The U.S. House of Representatives sent a strong message, through yesterday’s vote, that small businesses — like those represented by ASA — deserve a chance to thrive. H.R. 7024 helps make that vision possible. Many thanks to U.S. House Ways and Means Chairman Jason Smith for his leadership in putting this package together. ASA eagerly awaits the Senate’s consideration and passage of this bill so that it may ultimately receive the President’s signature.”

For more information on ASA, visit asashop.org.