The Automotive Service Association (ASA) supports the bipartisan and bicameral tax framework announced by U.S. Senate Finance Committee Chairman Ron Wyden (D-OR) and U.S. House Ways and Means Committee Chairman Jason Smith (R-MO).

Independent automotive repair businesses are currently confronting a litany of unique pressures that undermine their potential to thrive. These challenges include adapting to rapidly advancing automotive technologies, a shortage of technicians capable of handling these new technologies and high interest rates. If enacted, provisions in the Tax Relief for American Families and Workers Act of 2024 could provide much needed financial relief to ASA members. ASA urges Congress to pass this legislation.

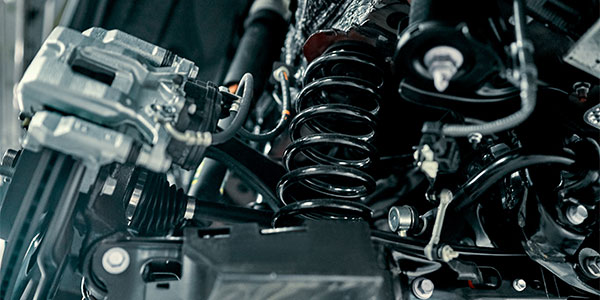

New technologies are upending the automotive repair industry. Repairers must contend with an influx of new electric vehicles, telematics, autonomous and advanced driving systems that require sophisticated calibrations, and more. To continue serving their customers, repairers have had and will need to continue to invest in costly facility and equipment upgrades. Some of these expenditures may require assuming debt. This tax proposal would reclassify interest paid on that loan as an allowable deduction. It would also provide for a 100% bonus depreciation allowance for qualified property — such as equipment and vehicles — acquired and placed in service between Dec. 31, 2022 and Jan. 1, 2026. Additionally, the legislation would raise the maximum amount a business may expense for qualifying property from $1 million (reduced by the amount by which the cost exceeds $2.5 million) to $1.29 million (reduced by the amount by which the cost exceeds $3.22 million), adjusting for inflation for taxable years after 2024.

One provision in the framework of significant consequence to many repair business’ employees is the expansion to the Child Tax Credit. The bill would change how the maximum refundable credit is calculated by including consideration for the number of children in a household. It also increases the maximum per-child limit from $1,600 to $1,800 for tax year 2023, along with annual increases to the cap adjusted for inflation each ensuing year through 2025.

“Many independent repairers have had to spend heavily on new equipment and other investments just so their businesses can stay afloat and relevant in this turbulent automotive environment,” said Scott Benavidez, AMAM, president of the ASA board of directors. “Personally, I’ve had to invest in a whole host of specialty equipment for my repair shop over the last few years. It’s never been harder for independent repair shops to stay in business. The Tax Relief for American Families and Workers Act of 2024 would make it easier for businesses like mine to continue providing high quality service to our communities for years to come.”

Added ASA Washington, D.C. Representative Bob Redding, “I commend Chairman Wyden and Chairman Smith for reaching this important bipartisan legislative tax agreement. Across the United States, Independent automotive repair shops — as well as other small businesses and their employees — stand to benefit from the proposed revisions to the tax code. The framework provides some needed relief to independent automotive repair facilities. ASA hopes that Congress will emulate the leadership demonstrated by Chairmen Wyden and Smith by working expeditiously to send the legislation to the President’s desk.”

ASA is the largest and oldest national organization committed to protecting the automotive repair industry with one voice. Our members own and operate automotive mechanical and collision repair facilities responsible for the majority of all post-warranty repair services in the U.S. ASA advocates for the interests of its members and their customers in Washington, D.C. The education, resources and services ASA provides empowers its members in all 50 states to remain trusted stewards of mobility in their communities.

For more information on ASA, visit ASAShop.org.