The Missouri salvage law has been touted recently as one that should be adopted by other states and benefits the collision repair industry because it excludes airbags from the calculation of a “salvage vehicle.” But before we as an industry go rubber stamping any salvage law or attempt to use it as model legislation in other states, we may need to step back for a moment and look more carefully at exactly what’s contained within the document.

Several years ago during a conversation, an industry acquaintance said, “Be careful what you ask for. You may just get it.”

Vehicle salvage has long been a hot topic for anyone who’s involved in the collision industry, regardless of industry affiliation. Title laws, definitions and the like have been discussed and re-defined over the years. Sale of salvage for title only promotes other problems, and without a doubt, there’s a definite need to “kill” some titles so that the vehicle and title papers will never again see the highway. These vehicles should carry a “parts only” or “non-repairable” certificate. The consumer expects — and should have — disclosure on whether his vehicle is rebuilt.

So why am I concerned over the perceived benefits of the Missouri law? After all, by the bill excluding airbags from the calculations, won’t the effect be more repairable vehicles for our industry?

You’d think so, but that’s not the case here. It is better than laws that include inflatable restraint devices in the equation to define a salvage vehicle, but based on what we’re witnessing, there aren’t more vehicles for collision facilities to repair. The law, whether intended or not, has established for insurance companies a “benchmark percentage” that’s too low and didn’t exist before. (And insurers are now throwing everything but the kitchen sink into the economics of whether to fix a vehicle or not.)

My main concern, however, isn’t the law in and of itself; it’s the lack of collision industry input that went into it. This concern not only extends to Missouri and Kansas, but to the country as a whole.

It would take a lot more space than I have here to explain all the political things relating to this bill, but I can say this: Collision repair professionals shouldn’t have to find out at the eleventh hour about legislation that affects their business.

It’s my fear that, on a national basis, we may ask for similar laws and get them before we thoroughly take a look at what the final results of the law really are.

The Missouri law is a compilation of three similar bills introduced in both the House and Senate, of which the perfected language was rolled into Senate Bill 1233. This was a 195-page bill that was passed without opposition.

From testimony in the Kansas House Transportation Committee on a bill with almost identical language, it was noted by one representative on that committee that the same source had introduced bills with similar language in Missouri. In fact, this was the first notice to the collision repairer that there even was a Missouri bill.

The repair community became aware of the pending legislation when someone brought a copy of a proposed bill for Kansas to a meeting (given to him quietly by someone else) and asked what those at the meeting thought of it.

A quick scan of the Kansas bill raised several red flags, which led to making some calls to find out where things currently stood. As a result, I attended the next meeting of the House Transportation Committee in Kansas (the bill had already passed the Senate committee with no opposition).

At the meeting, a committee representative divulged that the person who’d introduced the Kansas bill had also introduced multiple, similar bills in Missouri. Thus, it became a bi-state proposition to track and assign personnel to sit in on all pertinent hearings.

One very important point must be made: As with any legislation, the bills in Kansas and Missouri contained both good and bad points of law. Both states assured that consumers have a better chance of knowing the history of the vehicle that they’re thinking about buying.

Missouri’s bill had the provision that allowed for certain items to be excluded in the damage assessment calculations — most notably, deployed airbags. The remaining items that were defined to be excluded from calculations of a “salvage vehicle” were tires, sound systems or any sales tax on parts or materials. Kansas’s law didn’t pass with the language pertaining to airbags in it, but it did exclude some items from calculations.

Missouri also contains language that requires owner notification when two or more major components are replaced. An example of a major component per this law is a frame and front section. These components are defined within the salvage document law. The owners must be notified to surrender the title, and it must be “branded rebuilt.” This provides a degree of consumer protection and has been present in Missouri law for quite some time, although for the most part, completely ignored. It gives notification and disclosure to owners whose vehicles have been severely damaged structurally yet still don’t meet the threshold of a “salvage vehicle” by definition under the law. The other side of the sword, however, is that it opens up consideration of some other issues — most notably, diminished value.

The bottom line is that whether intended or not, the real effect of the law has been to establish a “benchmark percentage” that’s too low and didn’t exist before. Add to this the fact that most insurance companies aren’t using the law percentage but a much lower percentage, and the effect is that repairable cars are disappearing from collision facilities at a rate faster than before the law.

It’s a given that with the exclusion of the airbags in the calculations that more repairables are available, but only as compared to a law that didn’t exclude airbags. When compared to business conditions before the law, collision repair facilities are seeing more vehicles being sent to the salvage pools.

Unfortunately, collision facilities without the proper equipment, the current accredited training or the desire to do a quality repair are probably being affected the least — since they’ll just continue to do what they’ve always done. It’s the mid-level and upper-end stores that will be affected the most.

Individual repairers have reported that they’re losing up to 25 percent more vehicles since the new law (with a 75 percent figure) went into effect. Most reported that they noticed a downturn immediately in the number of repairable vehicles because now there’s a “definite target” to shoot at and the target is being misused.

Insurance companies have been distributing excerpts of the bill and saying, “This is the new definition of a total loss. At 75 percent, we’ll total the vehicle regardless of reparability.” But nowhere in the law is a total loss defined, nor does it say that damages equal to or exceeding 75 percent constitute a total loss. What is does state is that at 75 percent, the vehicle must have a salvage title and that, in Missouri, it must be re-inspected by the highway patrol and that the title must be branded as “rebuilt salvage vehicle.”

The majority of insurance company personnel also are telling collision repair facilities that, “We’re going to set our computer to trip at 65 percent because of … [a variety of reasons — none related to the safe repairability of the vehicle] so you might want to keep that in mind when you write your estimates.”

It also appears that the bottom line of an estimate is being used to make the call as to whether it’s a “salvage vehicle,” rather than the “true cost of repairs” with the excluded items taken out as defined in the law.

Collision repair professionals who aren’t aware of this — and of what’s happening — can lose repairable vehicles very quickly.

Because “working” or real percentage being used is 10 to 15 percent below the 75 percent in the law and because many non-repair item dollars are being thrown into the “unofficial” calculation, we have many vehicles being sent to salvage and getting salvage or rebuilt titles that are, in fact, repairable vehicles.

Collision repair facilities are reporting that some vehicles are being totaled at 50 percent. It would appear that many vehicles are being declared totals for convenience rather than for structural or safety reasons. And this gives the consumer a distorted picture of whether his vehicle is repairable or actually unsafe to repair.

Economic cost of the claim is one thing; determining the point at which a vehicle should be declared a total loss, a salvage vehicle or a non-repairable vehicle is another. It doesn’t appear from the law that there was any intent that these two be combined into determining a salvage vehicle, but in practice, they are.

If it is a “salvage vehicle” by definition, the law seems to only allow that we consider “the total cost of repairs to rebuild or reconstruct the vehicle to its condition immediately before it was damaged for legal operation on … “ It doesn’t mention that we (or insurance companies) can take into consideration rental or any other non-repair cost-related items. While rental and other items are a cost of the claim, they’re not a cost of the repairs. And, generally, first-party owners have paid an additional premium, which is separate from the collision and comprehensive portions of the policy. On third-party claims, it also looks as if the law was intended to reflect only on actual repair cost and not incidental items.

The consumer is ultimately the one who really suffers with laws that aren’t intelligently thought through. For example, it appears that the consumer isn’t being given more choice and control over the disposition of his vehicle. In fact, even less choice is being given with the new law than with the law as it existed. So the claims of the “good” for the consumer may be heavily exaggerated.

It also appears that the presumption is that everyone makes a “good deal” on their vehicle and owes less than what the vehicle’s valued at. But what about the consumer who’s just purchased the vehicle with little down and a long note, which puts him upside down in the loan. Or, the owner who has a loan on the vehicle and must tell the lien holder that their asset now must have a “salvage title”? And is the lien holder or leaser still going to honor the loan if the vehicle owner decides to keep the vehicle, or is the consumer going to have to try and locate another loan, re-write a loan at a higher interest rate or run the risk of not being able to find another loan?

Finally on many model years, if the vehicle is drivable at all, some people may drive vehicles in an unrepaired state — and these vehicles have safety-related items or parts that may prematurely fail, which could result in other major or even deadly accidents.

The percentage in the law needs to be raised or done away with completely and then it needs to clearly define what makes a vehicle unsafe to repair or non-repairable.

Bottom line: The law isn’t all good or bad. And how good or bad it is and how much of it should be used as a guideline in other states should be scrutinized carefully before accepting or rejecting any of it.

It is now the law, but the great thing about laws is that they can be revisited and changed. The important thing, more so than the law itself, is that the collision industry get involved in their state’s legislative process so that they have input regarding legislation that’s written that could impact the industry.

Will you always get what you want? NO!

Will things always go the way you, as an individual, want? NO!

The important thing is that one voice is heard and then another and then another — until the collision industry is properly represented and its views and issues known.

Become involved in the process, and you’ll influence things that affect you and your industry in a positive way that could truly surprise you. The alternative is to not get involved and let someone who knows nothing about the repair industry write legislation that affects your business and your family.

I often hear one of two irritating statements from repairers as to why they don’t get involved: “It’s too expensive,” or “If I do get involved, insurers will retaliate if I take an opposite view.”

Yes, it is expensive, so don’t try to do it yourself. Get involved in an industry association. And remember that a call or a letter, to not only your representatives but also to your association, goes a long way in allowing them to help you.

As far as retaliation, if you’re truly “partners” with a particular insurance company, shouldn’t they be willing to work with you on issues that affect both of you? If not, are they truly a partner?

Legislation concerning our industry is probably the single biggest factor that’s going to affect you and your business in the future. It’ll have a direct effect on the bottom line of every collision facility, no matter its size. Therefore, it’s only common sense to become active and to have a say in determining the course things are to take.

There’s a saying that goes something like, “If you do what you’ve always done, you’ll get what you’ve always got.”

If you don’t like the makeup of an association, meeting or trade group, the only way to change it is to show up. You CAN make a difference, but as always, it’s a free country and it’s your choice.

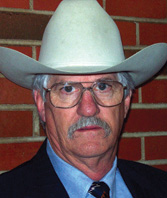

Writer Bob Smith has been in the collision industry for more than 39 years, starting out racing cars for fun as then as a factory team representative. After receiving a degree from the University of Missouri, he worked 10 years as a staff adjuster for Shelter Insurance, while maintaining a full-time, national racing schedule. He then started a company that built race cars and engines. He also worked as an appraiser for a fellow racer and friend in emergencies, prompting him to found STORM Appraisal & Management Service, Inc. in 1982, a company he still owns. A self-admitted workaholic, Smith is currently, among other things, the executive director of the Missouri/Kansas Chapter of SCRS, National Director for SCRS, co-chair of the CIC Ethics/Fraud Committee and secretary of the National Auto Body Council. He enjoys tournament bass fishing, golf, music and pets (including miniature donkies).

| The views expressed in this guest editorial do not necessarily reflect those of BodyShop Business magazine. |