It was May 2012 when 18 shops in the Birmingham, Ala., area shocked the collision repair industry by voluntarily terminating their Select Service agreements with State Farm after the insurer introduced the PartsTrader electronic parts procurement program in their market.

More than a year later, a check in with some of the shops indicates that most are faring better than other collision repairers probably would have thought.

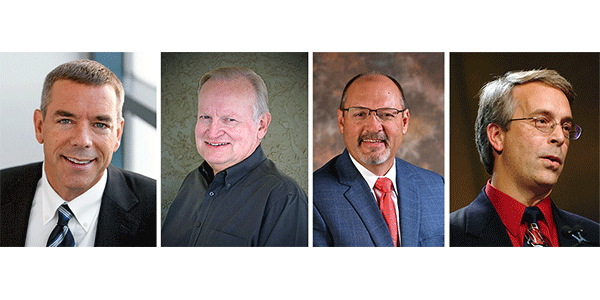

Steve Plier, founder of the Alabama Automotive Repair Industry Society of Excellence (ALARISE), said that overall, those shops have reported lower volumes of State Farm work but higher profit margins.

“I do believe a couple of the smaller two-man shops that removed themselves from the program have most likely struggled more than the $1 million and up per year repairers, but I believe that has more to do with total volume being down versus simply the State Farm/PartsTrader issue,” says Plier. “Business in the metro Birmingham area since early 2012 (before PartsTrader rolled out) has been what I would consider to be slow across all insurance company lines. In the spring of 2011, central Alabama was hit hard by strong storms, so the volume since late 2011 has not been what I would consider brisk.”

Lloyd Bush, owner of Bush Auto Collision Repair in Gardendale, Ala., admits it was a “gut-wrenching decision” to drop Select Service since State Farm accounted for 44 percent of his work, but overall he has come out okay.

“We’ve lost 5 percent of our gross sales, but our net profit has gone up,” says Bush. “We’re able to charge storage, our teardowns aren’t scrutinized and our local State Farm agents are still sending us business. I spoke to them before coming off the program to tell them what was going on, and they agreed with me and said, ‘We don’t send people to you because you’re on the program; we send them to you because we know you’ll fix the car correctly and we won’t have any problems.’”

Bush attributes the 5-percent loss to steering, mainly customers who have never been to his shop before and make a claim via the call center instead of their agent.

“The local agents don’t steer against me,” Bush says. “They let the customer know it’s their right to take their vehicle where they want.”

Bush says if faced with the same decision today, he would make the same choice, primarily because of the storage he has been able to charge due to no longer having a contract with State Farm.

“Storage is so much better than net profit,” he says. “Without any warranty or liability, it pretty much goes directly to the bottom line. And if you treat that customer really well while they’re in your shop, they’ll come back next time. I used to cringe every time a total loss was towed in because I knew it was going to be from State Farm. Now, I love them. They’re my biggest moneymaker.”

Bush points out another thing he never used to be able to charge for: lift time.

“I’m not going to charge someone for lift time if I end up doing the repair, but if not, I have to. The lift wasn’t free, plus one of my men has to do it,” says Bush. “When I was writing estimates for State Farm, I didn’t get to charge them for that. That’s money right there.”

Another benefit Bush has realized is reduced administrative work, which has allowed him and his staff to spend more time scrutinizing estimates.

“We had so much administrative work – taking pictures and labeling each one, them calling us over $3 or $5 items – that has now gone away so we’re able to not only pay attention to State Farm work but also other insurers’ work, which has allowed us to find money that was falling through the cracks,” Bush says.

Ginger Lowrey of Riverchase Collision Repair in Hoover, Ala., dropped State Farm after 17 years on their program. Like Bush, she has seen a drop in business, specifically 25 to 30 percent fewer vehicles to repair. But she has felt a certain liberty in not having to comply with the insurer’s agreement and being able to profit on total losses.

“We’re not jumping through hoops with them so much, and if they pull a vehicle from here that’s a total, we get to charge for what we’re doing,” she says. “It’s lovely in that I don’t have to do everything they tell me to do and I can at least make a profit in some aspects. But they’re still not paying the rates I charge unless it’s a total and they want the vehicle out of here and it’s racking up storage charges each day.”

After opting out of Select Service, Lowrey pulled the names of everybody who had come to her shop through State Farm, whether a first- or third-party claimant, and sent them a letter explaining that Riverchase had elected to remove itself from Select Service due to ethical issues.

“We wanted to remind them that it was their vehicle and their choice and we wanted to keep them as customers and would continue to take care of them the way we always had,” Lowrey says. “In doing that, we captured a lot of the business we had from State Farm over the last 17 years.”

As for shops that are currently still on Select Service and using PartsTrader, Plier says they have some frustrations.

“Shops currently on the Select Service program and using PartsTrader do not seem happy with the additional work required since the fax-only option was discontinued in September,” he says. “In fact, there are currently no suppliers locally on PartsTrader for Toyota, Honda, Kia and Hyundai in the Birmingham metro market, unless something has changed. Also, there is currently only one Nissan supplier (Moore Nissan in Bessemer, Ala.) that has an inventory of less than $100,000 per quotes made by repairers attempting to purchase parts from them.

“Shops indicate frustration that State Farm has started warning them unless they purchase from suppliers on PartsTrader, they’ll be removed from the Select Service program, reversing their earlier promise that they would always be able to buy from the supplier of their choice. Repairers are also frustrated that, if no bids are received through PartsTrader, they’re expected to revert back to their old practice of calling and searching for parts.”

Lowrey laments that the business relationship between State Farm and shops has gone from what she described as the “same team with a common goal of repairing the customer’s vehicle properly” to “who’s going to make the most off this job,” but she says she’s committed to doing what’s right.

“The independent shops have taken a bit of a hit and have to work harder and smarter for what we get, but hopefully things will change. We have to make ‘X’ amount on a job just to keep our doors open, and what we’re not going to do is start cutting corners and not repairing vehicles properly just so we can keep our doors open. That’s not going to happen.”

More information:

Mississippi Lawyer Updates Ohio Collision Repairers on PartsTrader Injunction