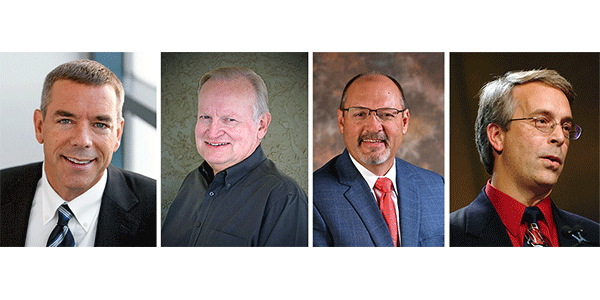

The investment banking team at Focus Advisors recently sat down with some key industry leaders and posed several provocative questions about pressing issues.

Over the course of many hours, these deeply experienced entrepreneurs shared their own thoughts, opinions and principles on which they’re growing their businesses. The following are some brief comments from each of them.

What are the most alarming and reassuring trends you saw or experienced in the industry during COVID?

Matt Ebert, CEO, Crash Champions: The inflation is alarming. Historically, our ability to increase prices has been really slow. Even more alarming is the lack of interest in the future workforce. There’s no magic thing that has happened to make the industry more appealing for people that want to jump into it. The problem of attracting young people to the industry has kept a lot of people up at night. For Matt Ebert’s full interview, click here.

Vartan Jerian, CEO, VIVE Collision: COVID-19 has accelerated the challenges in the labor force. The COVID-19 environment pushed many that were considering retirement into retirement, some technicians have pivoted into other industries as job opportunities have become more fluid. So, I think the COVID-19 environment has really exacerbated the labor shortage issue and it’s placing even more of a spotlight on the industry to work together to implement creative strategies to build a deeper technician candidate pool. For Scott Leffler and Vartan Jerian’s full interview, click here.

Does the industry really need 30,000 shops?

Jacob Tilzer, CEO, Kaizen Collision: I don’t believe the industry needs more of the same templated shops. What’s going on right now is that we’re losing the good shops where owners really took care of people and focused on people. I’m really trying to preserve what I feel are some of the best people for culture and the business because those are the people that are going to win the race in my opinion. For Jacob Tilzer’s full interview, click here.

Vincent Romans, CEO, The Romans Group: It is my estimate that eventually the number of relevant and utilized collision repair facilities in the U.S. will move to between 22,000 and 25,000 by 2030. For Vincent Roman’s full interview, click here.

Matt Ebert: Here’s the math. A shop that does less than $300,000 a month doesn’t make a lot of financial sense unless the rent is cheap enough. But in my experience, for the numbers to be profitable, you need at least that much volume at a location. With the average shop in the U.S. doing about $1 million annually, it’s not sustainable for the industry or the people in it. Ultimately, I don’t think the industry needs 30,000 shops.

How does the technician shortage affect your growth plans?

Shawn Crozat, CEO, G&C Auto Body: Not at all. Part of our growth plan is how do we get better at retaining my talent, how do we get better at growing new talent and how do we get better at recruiting. That’s part of what I work on in my calendar everyday — staffing and recruiting for an hour. We work a lot on employee surveys and getting feedback. Part of growth is not just ‘How do you buy shops?’ but ‘How do you keep your people happy?’ — that’s part of what you have to do to keep growing. It’s not easy, but the technician shortage doesn’t affect our plans for growth. For Shawn Crozat’s full interview, click here.

Vartan Jerian: The technician shortage makes our growth plan — and expanding our operations — that much more important. With scale, we can offer more robust benefits and training opportunities to attract and retain talent. As a people-first organization, we take a hands-on approach to attracting and developing our team. We are working at the grassroots level across our organization, developing relationships and apprenticeship programs with local trade schools in the markets in which we operate.

What aspects do you consider in your key criteria for deciding whether to buy or pass?

Jacob Tilzer: Probably why we’ve grown so fast is that I don’t start with the income statement. I don’t go right into somebody’s numbers and say “Hey, this is great, this is buyable cashflow.” I start with the leaders of the organization and that gives me a sense of how they lead the people that we’re going to be acquiring. I don’t view acquisitions as just acquiring locations and EBITDA — we acquire great people and operators.

Shawn Crozat: We have a matrix to rank all the shops we are considering. First, we look at sales price, required capital investment, potential revenue, market size and what DRPs we can get. Then we look at strategic geographic locations, fit with our other shops and rent per square foot. And we look at how easily we can get talent. We put all of our stores up and rank opportunities on a one through three scale. From there, we decide what deals to pursue and which to walk from.

What is the best preparation a seller can make?

Scott Leffler, co-founder, Vive Collision: One is being mentally prepared. When shop owners are indecisive about what they are looking to accomplish, it makes the process challenging. That’s why working with deal professionals like Focus Advisors, that help owners flush out what they’re looking to accomplish, typically makes the transaction process more efficient.

Shawn Crozat: The difference between someone that is prepared and not prepared is usually clean financials and an updated asset list. They know what they have and they can tell that to you quickly.

Does shifting market share among insurers affect your appetite for expansion?

Matt Ebert: Market share has been shifting to the largest companies for a while now, so if that’s where all the work is coming from, it seems to me like that’s where you want to be. I look at it from a nationwide perspective. The big four almost everywhere are State Farm, Allstate, Progressive and GEICO. Then in different markets like California, you’ve got other ones that are much bigger than in other parts of the county like Mercury and Farmers. But the top four to me seem to be consistent everywhere.

Vincent Romans: Most of the top 15 insurers support using consolidators and smaller regionals verses smaller one-shop operators. Managing and tracking repair operators is more efficient and streamlined when utilizing various sized MSOs versus a broader network of repairers. While smaller one-shop operators will continue to be utilized, their volumes will continue to diminish over time. It will be increasingly difficult for them to reach the right regional and corporate insurer decision-making personnel.

Read the full interviews at focusadvisors.com.

Focus Advisors is the industry’s go-to M&A firm. Over the past seven years, the company has led more than 40 transactions totaling more than $500 million and more than 300 collision repair shops. For a confidential discussion about your plans, contact David Roberts at [email protected] or call (510) 444-1173.