A South Carolina body shop has called out Allstate due to what it claims are faulty repairs of a customer’s car.

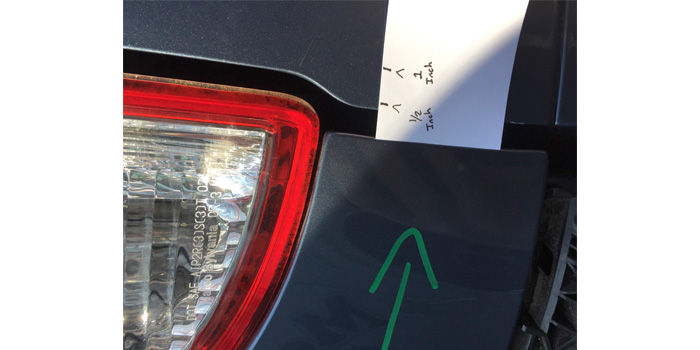

On Feb. 23rd, Ascue’s Auto Body & Paint Shop was contacted by an Allstate insured who had been referred to one of Allstate’s preferred shops. She contacted the shop because she was concerned about the repairs that had been done at that preferred shop to her 2011 Toyota RAV4. After visually inspecting the vehicle, Ascue’s found that an imitation taillight had been installed during the repair and, from the underneath, they could see that a knock-off impact bar was used and was not in the correct mounting position to the rear body panel (all of which, the shop decided, were safety concerns). Also, the color of the rear cover did not match the quarter panels, and the quarter gap to the rear gate was almost a 1/2 inch wide.

“We suspected that there was still structural damage and informed her that it was not safe to drive around,” said Jordan Wooten, operations manager of Ascue’s.

On Feb. 25th, Ascue’s took the vehicle apart and began to measure the frame. During the setup, prior to measuring, the shop found several places where there was no corrosion protection used, raw welds, overspray, imitation part fit issues and clamp damage. The vehicle’s structural integrity, Wooten says, was compromised based on half of the measurements taken. Ascue’s wrote an estimate on what it would take to repair the RAV4 and sent it to Allstate. On Feb. 26th, a representative from Allstate came out to the shop to go over the repairs needed.

“When we were going over what needed to be repaired on the vehicle, the Allstate inspector barely discussed what was needed, took minimal pictures, paid little attention to what I was saying to him and then got in his car and left,” Wooten says. “After he left, he called the vehicle owner and told her that he didn’t see anything wrong with the repair other than a gap being a little wide in the back of the car. He then told her that ‘Allstate doesn’t want to deal with Jordan Wooten’ and that they would only deal with their insured. He went even further by telling her that if she wanted a diminished value claim, she did not need to hire an appraiser because Allstate would handle it.”

On Feb. 29th, Wooten says he asked Allstate if they were going to pay for any additional damages or pay to correct the repair, and they said no.

“The Allstate appraisers that were here on the property said that no additional charges from Ascue’s Auto Body would be covered and that [the customer] needed to pick up her car. I told them that the structural measurements were out of tolerance and it could be unsafe, and he said, ‘At this time, no accrued charges will be covered.’

“So currently, our customer, an Allstate insured, is stuck with a vehicle that is potentially unsafe and a hazard for other drivers on the road. Our mutual customer has been with Allstate for approximately 10 years and only wants to be indemnified completely. The accident was not her fault. Is this what can be expected when a customer is referred to one of Allstate’s preferred shops? Is Allstate not going to help their own insured? ‘Allstate provides a written guarantee of repairs for as long as you own the vehicle’ – is Allstate’s repair guarantee worth nothing?”

Update: according to Wooten, Allstate called the customer on March 5th and told her they will be totaling her vehicle and buying it from her. It is now a total loss.

Click here to watch a video from ABC News4 on the case.

Ascue’s also recently took on State Farm over what they felt was a subpar repair from a Select Service shop.