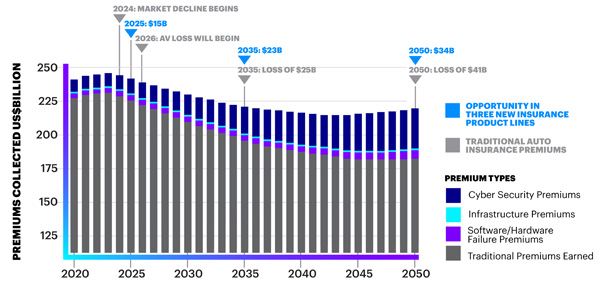

The rise of autonomous vehicles will be a mixed blessing for U.S. auto insurers, according to a new report.

The good news for insurance carriers is that coverage for autonomous vehicles will bring $81 billion in new premiums over the next eight years, according to the report from Accenture and Stevens Institute of Technology.

Risks related to cybersecurity, software and hardware will drive the short-term uptick in insurance premiums, the firms predict.

Then there’s the not-so-good news: If autonomous vehicles fulfill their promise of making the roads safer – and policies shift from consumers to autonomous vehicle manufacturers and other service providers – insurers will see reduced demand for personal insurance, the report asserts.

“Insurers are bracing for long-term declines in auto premiums as new and safer autonomous vehicles gain adoption,” said John Cusano, a senior managing director at Accenture and global head of the company’s Insurance practice. “However, our research suggests that auto premiums will increase before they decline on this trend, so insurers that can navigate the changing technology environment could win market share.”

Cybersecurity: Greatest Potential Driver of Premiums

For the report, “Insuring Autonomous Vehicles: An $81 Billion Opportunity by 2025,” Stevens Institute of Technology in Hoboken, N.J., developed several models to evaluate the impact of autonomous vehicle technology on the insurance industry. The models were applied to different scenarios and insurance products based on parameters set by Accenture’s Insurance and Connected Transport teams.

“Three new business lines – cybersecurity, product liability for sensors and software algorithms, and public infrastructure – are going to drive billions in new insurance premiums for the U.S. auto insurance industry in the coming years,” said Larry Karp, a co-author of the report and global insurance telematics lead in Accenture Mobility, part of Accenture Digital. “Forward-thinking insurers are already putting these new products at the top of their agenda as they look to capitalize on the first-mover advantage.”

The research found that cybersecurity insurance will be the greatest potential driver of new premiums, totaling $64 billion by 2025, followed by product liability insurance ($14 billion) and public infrastructure insurance ($3 billion).

The three new business lines include:

- Cybersecurity – Protection against remote vehicle theft, unauthorized entry, ransomware and hijacking of vehicle controls, as well as coverage for identity theft, privacy breaches and the theft or misuse of personal data.

- Product liability for sensors and software algorithms – Manufacturer coverage for failures related to communications (e.g., Internet connection), software (including bugs, memory overflow and program defects) and hardware (sensory circuit failure, camera vision loss and radar and lidar failures).

- Public infrastructure – Insurance for cloud server systems that manage traffic and road networks, in addition to failure of external sensors and signals, and communication problems originating at the system level.

“This research is an important step in helping insurers understand how their business models need to evolve over the next decade,” said Chen Liu, co-author of the report and a research assistant at Stevens Institute of Technology’s School of Systems and Enterprises. “Autonomous-vehicle technology will drive a significant shift in risk from human error to malicious third-party, software, hardware and infrastructure risk. Understanding and proactively responding to this anticipated enterprise transformation is imperative.”