TeleTech has released the findings from the “2015 TeleTech P&C Customer Satisfaction Survey.” The research report looks at which factors drive customer satisfaction during the claims process.

As part of the survey, more than 300 consumers were asked about how the claims process influences customer satisfaction. The survey found that multiple factors are involved, including how policyholders were treated, the claims process and channel interactions. The most influential attribute of the claims experience was “my insurance company acted in my best interest.”

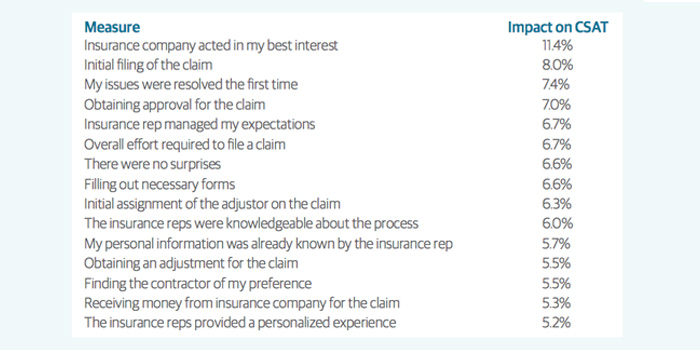

The following are the most significant predictors of customer satisfaction (CSAT):

The TeleTech study found that satisfaction is not the single factor in driving business results. The item “the insurance company acted in my best interest” was the most important predictor of overall satisfaction, however, looking at average current satisfaction levels, it ranks much lower than the claim filing process and knowledgeable reps. This reveals that the things people are less happy with now are sometimes the most important for future success.

The study also found that channel-specific satisfaction is important to overall satisfaction. So it’s vital that companies focus on what channel their policyholders like and make sure that they provide a good experience in each.

The most used channel, by far, was phone. This was followed by speaking to a rep in person, and then using the website, mobile app and self-service. Findings reveal that channels that were preferred by respondents (and used more often) were also the channels for which channel satisfaction had a bigger impact on overall satisfaction.

TeleTech, based on their survey findings, recommends the following best practices to insurers to optimize customer experience:

- Focus your analysis on a specific point in the customer journey to ensure a clear and actionable set of results, such as the claims process.

- Use analytics to determine the coalition of variables that affect customer experience in your business, and identify what key areas have the most impact on customer satisfaction.

- Educate the organization on how each area impacts the customer experience.

- Prioritize the key areas that have a high impact on CSAT and provide a good opportunity for improvement in the customer experience.

- Implement process improvements for the key areas determined.

- Continually monitor success and make adjustments where necessary.

To read the full research report, click here.